Description: A practical 2025 guide to LED holographic screens—how they work, where they make business sense, and how B2B teams can evaluate ROI, risks and implementation compared with traditional displays.

Standing in front of a flagship store or airport atrium, you’ve probably seen it: a sneaker, a car model, or a logo floating in mid‑air, bright enough to cut through sunlight yet the glass behind it remains see‑through. As someone who has sat in many design reviews for transparent LED and holographic projects, I see the same tension every year—marketing wants “wow”, engineering wants reliability, finance wants a defensible ROI. The global holographic display market is already in the billions of dollars, but that doesn’t mean every project should jump in head‑first. So the real questions become: what exactly is an LED holographic screen, does it truly outperform LCD, LED and projection today, where does it create measurable value, and how do you know whether to invest now or wait for the next product cycle?

Are LED Holographic Screens Really the Future of Displays?

An LED holographic screen is a transparent or semi‑transparent LED display engineered to create floating, 3D‑like visuals viewable with the naked eye.

In pure image quality for 2D video, holographic LED does not always beat fine‑pitch LED or OLED, but it outperforms them in spatial impact and transparency.

For high‑traffic retail, airports, museums and premium brand spaces, LED holographic displays already deliver ROI through higher dwell time and conversion.

In cost‑sensitive, utility‑driven applications (simple information boards), traditional LED/LCD is still more economical than holographic LED screens.

Outdoor LED holographic installations work when you design properly for brightness (often 5,000+ nits), structure, and content contrast.

The limiting factor is often not the screen itself, but content production workflows and integration with existing CMS and control systems.

For most B2B buyers, the right strategy is to start with 1–2 pilot sites, measure impact, then standardize design packages for scale.

What Is an LED Holographic Screen? Definitions, Variants and Core Concepts

From transparent LED to holographic effects: key definitions you must distinguish

The terminology in this space is messy, so aligning definitions saves a lot of confusion in RFPs and specs.

An LED holographic screen, in current commercial practice, usually refers to a transparent LED display or cabinet‑free LED grid that creates a strong depth illusion—objects appear to float in front of or inside the glass. Technically, it is not “true holography” in the physics sense, but a combination of:

Discrete LED emitters

High‑transparency substrates or grids

Carefully designed content with perspective, shading and motion

Adjacent terms you’ll see:

Transparent LED screen: high‑transparency LED strips or PCB on a clear substrate; allows 60–90% light transmission.

Holographic fan: high‑speed spinning LED “blades” that draw shapes in the air via persistence of vision.

Holographic projection: projection onto glass or film with special coatings; no LEDs at the image plane.

Most B2B projects that talk about “LED holographic” are actually talking about transparent LED or cabinet‑free grids mounted on glass or frames.

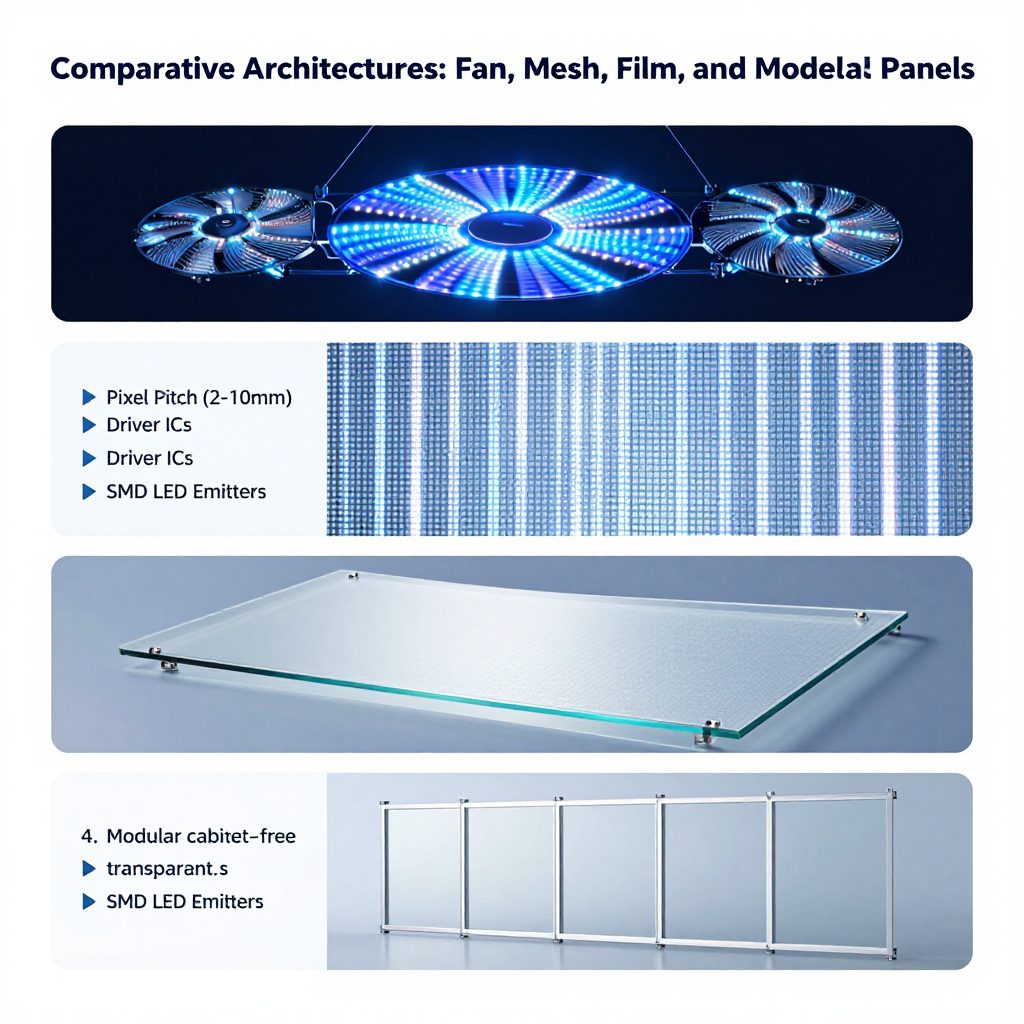

Types of LED holographic screens: fan blades, transparent LED mesh, film and cabinet‑free panels

From an engineering and application view, you’ll mostly encounter four categories:

Holographic fan displays

Structure: rotating blades with LEDs along the edge; wall‑mounted or suspended.

Pros: compact, strong “floating” effect, easy to move.

Cons: mechanical noise, safety enclosure required, limited size by design.

Typical use: small product highlights, kiosks, temporary events.

Transparent LED mesh / grille

Structure: vertical or horizontal LED bars with gaps; mounted in front of glass or in frames.

Pros: high brightness, up to 80–90% transparency, scalable to big façades.

Cons: visible lines when off at close distance, pixel pitch larger than indoor LED walls.

Use: media façades, large shopfront windows, atriums.

LED film and ultra‑thin panels

Structure: flexible LED or micro‑LED devices embedded in transparent or translucent film; often glass‑laminated.

Pros: seamless integration into glass, very light, good for curved surfaces.

Cons: more demanding on installation quality and glass processing, custom orders.

Use: high‑end retail, automotive showrooms, creative architecture.

Cabinet‑free transparent LED panels

Structure: modular panels with slim frames and transparent bars, lighter than traditional LED cabinets.

Pros: easier maintenance than film, high brightness, good balance of modularity and transparency.

Cons: requires structural planning for frames and cabling paths.

Manufacturers like Zhenmei Wisdom in Shenzhen focus on these transparent and holographic LED formats, plus related crystal film and flexible solutions, precisely because each architecture suits a different project type.

How holographic LED compares with LCD, OLED, MicroLED and projection‑based holograms

If you’re specifying technology, the key is not “which is coolest” but “which maps to the job”.

Versus LCD videowalls

LCD wins on cost per square metre, fine detail for close‑up viewing, and uniformity.

LED holographic wins on transparency, brightness, and impact for passer‑by traffic.

Versus OLED signage

OLED offers superb contrast and deep blacks, ideal for controlled indoor environments.

Transparent OLED exists, but is relatively expensive and limited in size compared to transparent LED.

Versus MicroLED walls

MicroLED is the long‑term challenger for ultimate image quality, but today remains premium.

LED holographic screens live in a different niche: architectural integration and see‑through media.

Versus projection holograms

Projection works well in dark environments and 360‑degree “hologram” stages.

LED holographic solutions are more sunlight‑resistant, require less depth behind the screen, and are easier to service.

So, is an LED holographic screen the future of display technology? It’s more accurate to say it is the future of a specific subset of displays: where architecture, transparency and immersive storytelling matter more than pure pixel density.

How LED Holographic Screen Technology Works: Engineering‑Level Explanation

Core components of a holographic LED display: LEDs, driver ICs, control system and optical layer

Strip away the marketing images and you’ll find very familiar components:

LED emitters: SMD or COB LEDs mounted on transparent PCBs, film or bar structures.

Driver ICs: control current and grayscale for rows/columns; impact refresh rate and flicker.

Power system: distributed power supplies, low‑voltage buses, sometimes integrated in frame profiles.

Control system: sender/receiver cards, fiber or Ethernet links, and media servers or players.

Optical layer: gaps, substrate, and coatings that manage how much daylight passes vs how the image appears.

In a transparent LED grid, each “strip” drives many pixels. The open area between strips lets natural light through. When content is bright and high contrast, the human eye tends to lock onto the LEDs and mentally “fill in” the missing areas, which is part of the perceived holographic effect.

Optical principles behind the “floating” 3D effect and high transparency

The 3D‑like effect doesn’t come from magic hardware; it is primarily:

Depth cues in content: perspective, occlusion, shadows.

Spatial positioning: screen offset from background objects, sometimes with multiple layers.

Ambient lighting: controlled enough that the LED image dominates foreground perception.

Imagine looking through a window where only 10–20% of the area has emissive pixels, but those pixels are 3,000–5,000 nits bright. Your brain prioritizes the moving luminous shapes over the static background you can still see. If content designers render objects with parallax, rotation and lighting changes, the result reads as “holographic” even though the panel is flat.

Transparency is influenced by:

Strip width vs spacing (open area ratio).

LED package size.

Routing of traces and mechanical elements.

Practical rule: for street‑facing windows, aim for at least 60–70% transparency if you want both daylight visibility into the shop and strong content impact after dark.

Key performance parameters: pixel pitch, brightness (nits), refresh rate, color depth and viewing angles

For B2B buyers, a spec sheet can be misleading if you don’t link numbers to actual use:

Pixel pitch (mm): distance between LED centers.

2–4 mm: suitable for indoor viewing at 2–6 m.

6–10 mm: shopfront and medium‑distance viewing.

10–31 mm: large façades where viewers are tens of metres away.

Brightness (nits):

Indoor: 800–1500 nits is often enough.

Semi‑outdoor / window: 3000–5000 nits.

Outdoor: 5000+ nits with good heat management.

Refresh rate and scan: higher refresh (≥3840 Hz) reduces flicker artifacts on cameras and improves perceived quality on fast content.

Color depth and calibration: more bit‑depth plus factory and on‑site calibration means smoother gradients and consistent color, critical for brands.

Viewing angles are generally wide horizontally; vertically they depend on strip orientation. For airport or metro projects where viewers look from above or below, this should be tested in mockups.

Materials, Structures and Installation Scenarios for LED Holographic Screens

Structural designs: glass‑mounted transparent panels, flexible LED film, and frame‑based holographic grids

From an engineering perspective, the mounting method often determines success more than the panel model.

Glass‑mounted transparent panels

Panels hung or fixed directly on the inside of curtain wall glass.

Lightweight frame systems distribute load onto mullions.

Good for retrofits: minimal impact on façade.

Flexible LED film

Film laminated inside glass during fabrication, or glued onto existing glass.

Nearly invisible when off; ideal where architects resist “hardware look”.

Demands tight coordination between glass supplier, LED manufacturer and installer.

Frame‑based holographic grids

Self‑supporting frames with integrated LED strips.

Used for stages, rental events, and indoor atriums where there is no existing glass.

Fast assembly and disassembly, important for events and touring shows.

Zhenmei Wisdom and similar manufacturers typically offer both film‑based and frame‑based options, because the same content strategy might be deployed in a shopping mall atrium and then adapted to a free‑standing event structure.

Materials and architecture integration: glass façades, retail shopfronts, atriums and stage sets

Integration is where many projects either shine or fall short. Typical scenarios:

Glass façades

Install from inside to avoid altering external appearance and permits.

Consider reflections: low‑iron glass and anti‑reflective coatings help.

Retail shopfronts

Mix transparent LED with clear areas so customers still see into the store.

Align LED modules with mullion grid to avoid awkward cut lines through key visuals.

Atriums

Use multiple transparent LED layers to create depth, e.g., three staggered grids with synchronized content.

Pay attention to viewing angles from different floors.

Stage sets and exhibitions

Combine holographic grids with conventional LED walls and lighting.

Structural engineer should confirm hanging loads from trusses or ceilings.

Installation constraints B2B buyers must plan for: load‑bearing, cabling, ventilation and safety

The “invisible” look hides real engineering constraints:

Load‑bearing

Even “lightweight” transparent LEDs add tens of kilograms per square metre.

Verify glass thickness, mullion capacity, and attachment points early.

Cabling and power distribution

Decide whether to run cables along mullions, ceilings or floor troughs.

Avoid visible cable clutter that kills the premium aesthetic.

Ventilation and heat

High‑brightness LEDs generate heat; ensure airflow behind panels.

Avoid fully sealing panels into cavities without exhaust.

Safety and regulations

Check local codes on glass signage, falling objects, and fire behaviour of plastics.

For fan‑type holographic displays, protective enclosures and distance from public are mandatory.

When scoping early, ask your integrator for a simple load and power map, not just a pretty rendering. It will save redesign cycles and approval delays.

Why LED Holographic Screens Matter for the Future of Display Technology

Immersive 3D‑like experiences without glasses and their impact on viewer engagement

Attention is now the scarce resource in physical spaces. A standard 2D screen at the back of a window competes poorly with smartphones and urban visual noise. Holographic LED screens:

Pull content into the pedestrian’s path instead of behind glass.

Create perceived depth and motion that stands out from flat backdrops.

Enable product storytelling that feels more physical—cars spinning in space, shoes breaking apart into components, architecture unfolding.

Industry pilots show that transparent/holographic window installations can increase dwell time by 30–60% compared with static lightboxes, which in turn correlates with higher in‑store entry and lift in campaign awareness.

As one retail design director put it to me: “We stopped thinking of the glass as something to look through and started treating it as media real estate.”

How transparent holographic LED enables media façades and “invisible” screens in architecture

Traditional LED façades often face pushback from architects and city regulators because they fundamentally change the appearance of the building. Transparent LED and holographic grids change the equation:

From outside, the building still reads as glass architecture in daytime.

At night, the façade becomes a controllable media surface without heavy boxes.

Inside, occupants keep access to daylight and views.

This makes it easier to:

Negotiate permits in city centres.

Maintain a premium brand image (no “Vegas billboard” look).

Integrate signage into corporate campuses, airports and transport hubs.

Synergies with AI, spatial computing and interactive sensors in next‑generation digital spaces

Looking toward 2030, the interesting part is not just the display itself but its role in a larger spatial computing stack:

AI‑driven content can adapt to time of day, crowd density and weather.

Sensors (LiDAR, cameras, touch sensors) can trigger interactive holographic scenes as people approach.

AR devices can layer additional information on top of the same façade, aligning virtual objects with the LED content.

LED holographic screens effectively become the “anchor” in the physical world for these digital layers—high‑brightness, large‑scale, and permanently visible even when no one wears a headset.

Key B2B Application Scenarios: Where Holographic LED Displays Create Real Value

Retail windows and shopping malls: turning glass into dynamic, high‑impact advertising

Retail is currently the strongest adoption sector:

Flagship stores use transparent LED to launch products with full‑scale floating visuals.

Malls use holographic LED grids in atriums to run seasonal campaigns and sponsorship content.

Local stores run time‑of‑day content: promotions during rush hours, brand stories at night.

The value drivers are:

Higher stopping power on the street.

Ability to change campaigns without printing and labour.

Brand differentiation vs neighbouring stores with static glass.

Events, exhibitions and brand activations: staging 3D product storytelling and live experiences

For events and experiential marketing teams, holographic LED provides:

Portable stage portals where presenters walk “behind” floating objects.

Product demos where exploded views and animations hover in front of the real hardware.

Corporate events with signature holographic intros and transitions.

Rental‑friendly modular grids and frames are key here, as is fast rigging and pre‑built content templates that agencies can adapt quickly.

Museums, corporate lobbies and transportation hubs: information, wayfinding and digital art

Beyond advertising, we’re seeing museum and infrastructure applications:

Museums combine transparent LED with physical artefacts, layering timelines, maps and 3D reconstructions.

Corporate lobbies replace static reception walls with dynamic holographic timelines and ESG dashboards.

Airports and metro hubs use transparent LED on glass barriers and mezzanines for dynamic wayfinding and public art that doesn’t obstruct sightlines.

These projects often involve multiple stakeholders—architects, curators, operations teams—so vendors with real engineering experience and reference projects, such as Zhenmei Wisdom, tend to be favoured over pure hardware traders.

Business Case and ROI: When LED Holographic Screens Beat Traditional Displays

Cost structure and pricing drivers: hardware, content production, installation and operation

Total project cost splits roughly into:

Hardware: LED modules/film, frames, power, control systems.

Installation: steel or aluminium structures, glass works, cabling, lifts and access.

Content: 3D modelling, animation, rendering, adaptation to campaigns.

Operation: power, control room integration, monitoring, maintenance.

Key cost drivers:

Pixel pitch and transparency level.

Custom shapes or curved glass vs standard modules.

Site complexity (height, access, working at night, permits).

Degree of content sophistication (simple loops vs fully interactive).

ROI framework: how to estimate uplift in traffic, dwell time and conversion from holographic content

For decision‑makers, the simplest ROI model is:

Measure current baseline:

Footfall past the window or location.

Entry rate into store or zone.

Conversion rate or relevant KPI (sales, sign‑ups, inquiries).

Estimate uplift from holographic LED:

Conservative: 10–20% increase in dwell and 5–10% in entry rate.

Aggressive for flagship activations: higher but time‑limited.

Assign financial value:

Extra visitors × average basket value or lead value.

Compare with annualized CAPEX + OPEX for the installation.

For many premium retail sites, a well‑executed holographic façade can pay back in 18–36 months when tied to big product launches and media partnerships, especially if the screen can also be sold as advertising inventory.

Total cost of ownership: energy consumption, lifetime, serviceability and upgrade paths

Holographic LED’s TCO profile is similar to traditional LED, with a few nuances:

Energy: transparent LED often consumes less power than fully packed LED walls at similar brightness, because there are fewer diodes, but high‑nit operation still matters.

Lifetime: typical 50,000–100,000 hours LED lifetime, assuming proper drivers and heat design.

Serviceability: modular panels or strips that can be replaced individually are critical; avoid sealed designs with no easy access.

Upgrades: choose systems with standard control protocols so future media servers and CMS can integrate without ripping out hardware.

A well‑designed installation aims for a 5–7 year lifecycle with mid‑life content refresh and optional component upgrades (e.g., new sender cards, new media servers) rather than full replacement.

Technical Challenges, Limitations and How the Industry Is Solving Them

Brightness, contrast and ambient light: indoor vs outdoor performance trade‑offs

Ambient light is the biggest technical constraint:

In strong sunlight, contrast can drop dramatically if content is not tuned.

Highly transparent grids have less LED area, so apparent brightness per square metre is effectively lower.

Mitigation strategies:

Design content with high contrast, bold shapes and limited fine detail for daytime.

Use automatic brightness sensors to adjust output and avoid washout or glare.

In sensitive urban locations, implement brightness schedules to respect neighbours.

Content production challenges: 3D assets, rendering workflows and CMS integration

Most disappointing projects suffer from weak content, not weak hardware.

3D pipelines: you need designers comfortable with 3D tools, not just flat video editing.

Resolution planning: design at the actual LED pixel matrix, not the glass dimensions.

CMS integration: confirm early how the holographic canvas fits into your existing digital signage or DOOH platforms.

Some suppliers provide turnkey packages: display + content templates + control. Others, including integrated manufacturers, can work with agencies but you should plan that budget explicitly rather than treat it as an afterthought.

Reliability, heat, and environmental factors: IP rating, maintenance cycles and spare parts

For outdoor or semi‑outdoor use, basic questions make a big difference:

IP rating for front and rear (e.g., IP65 front for rain, lower rear if protected).

UV stability of plastics and adhesives in film‑based products.

Access strategy: from inside the building, from outside via lifts, or from catwalks.

Always specify spare module and power supply stock (typically 3–5% of installed quantity) and a defined response time for critical sites like airports or flagship stores.

LED Holographic vs LED Crystal Film, MicroLED and Other Alternatives

LED holographic screens vs LED crystal film: transparency, image quality and use cases

LED crystal film screens are another flavour of transparent display:

Higher transparency and more seamless look when off, because the LEDs and traces are extremely fine.

Typically slightly lower brightness and different pixel architecture than grid‑type holographic LED.

More complex glass integration, but stunning for luxury retail and automotive.

LED holographic grids are:

Better suited for larger surfaces and higher brightness.

Simpler to service and retrofit.

Many manufacturers, including Zhenmei Wisdom, offer both, so specifiers can choose per location rather than forcing one technology everywhere.

How holographic LED compares with MicroLED walls, LCD videowalls and OLED signage

In a 2025 project portfolio, you might realistically use:

MicroLED or fine‑pitch LED indoors for conference centres and control rooms.

LCD videowalls where budgets are tight and ambient light is moderate.

OLED for high‑contrast premium indoor signage.

Transparent holographic LED for windows, façades and “wow” zones.

The goal is a mixed ecosystem where each technology handles the task it’s best at, instead of trying to make holographic LED serve as a simple menu board.

Choosing the right display technology mix for your projects in 2025 and beyond

For each space, ask:

Is transparency or pure image fidelity more important?

What is the typical viewing distance and dwell time?

Is the content primarily informational, or experiential and brand‑led?

Only when you map these answers to the technology options does the “future of displays” question become concrete rather than abstract.

Planning and Implementing a Commercial LED Holographic Screen Project

Assessment checklist: objectives, space conditions, content strategy and budget range

Before you call vendors, answer four issues internally:

Objective: drive sales, brand impact, information, or all three?

Space: glass types, dimensions, sun path, structural constraints, viewing distances.

Content: in‑house capacity vs agency, level of 3D storytelling desired.

Budget: both CAPEX and a realistic annual content/maintenance budget.

A simple one‑page brief with photos, dimensions, and objectives will get you far better proposals than a vague “we want a holographic screen”.

High‑level implementation workflow: from technical survey to commissioning and testing

A mature project typically follows:

Site survey and feasibility: structure, power, network, access.

Concept design and budgeting: preliminary engineering + visual mockups.

Detailed engineering: load calculations, brackets, cabling, control room integration.

Manufacturing and FAT (factory acceptance test).

Installation and SAT (site acceptance test) with calibration.

Content deployment, training and handover.

Manufacturers with integrated R&D and production like Zhenmei Wisdom can shorten steps 3–5 by using proven module families and reference designs.

Partner selection and RFP tips: what to ask LED holographic screen vendors and integrators

In RFPs, include questions beyond unit price:

Reference projects of similar scale and environment.

Pixel pitch, transparency, brightness and IP rating actually delivered on those projects.

Service model: on‑site vs remote, spare parts policy, SLA times.

Integration experience with your preferred CMS or control platform.

You can also ask candidates to propose both a holographic solution and a “Plan B” using more conventional displays, to validate that you’re not over‑specifying technology where it doesn’t add value.

Common Misconceptions and Risks Around LED Holographic Displays

Myths about “true holograms”, viewing angles and 360‑degree visibility

One persistent misconception is that LED holographic screens create volumetric 360‑degree imagery. They do not. They are directional surfaces:

Best effect is from the design viewing zone; side angles are still fine but not magical.

“True holograms” in the physics sense are still lab‑grade or niche.

Managing stakeholder expectations early prevents disappointment and unrealistic creative briefs.

Over‑promised transparency and brightness: what specs really mean in practice

Marketing brochures often list “90% transparency” and “6000 nits” in the same line. In practice:

Maximum transparency and maximum brightness do not occur simultaneously at all viewing angles and conditions.

Transparency claims usually ignore structural elements like frames and cabling.

Whenever possible, insist on:

A small mockup on similar glass.

On‑site tests at the brightest time of day.

Hidden risks: regulatory approvals, glass safety, reflections and content fatigue

Additional pitfalls that seasoned teams watch for:

Regulatory: some cities limit moving or flashing content on façades; others require permits for anything covering glass.

Glass safety: added loads and potential thermal stress must be evaluated by façade engineers.

Reflections: polished floors and nearby glass can create confusing ghost images.

Content fatigue: spectacular content that never changes becomes invisible after a few months.

A sustainable content plan, not just a launch animation, is essential.

Operation, Maintenance and Lifecycle Management for Holographic LED Screens

Routine inspection, cleaning and calibration practices for stable image quality

Day‑to‑day operations should include:

Visual walk‑throughs to spot dead pixels, flicker, or colour drifts.

Scheduled cleaning of glass and exposed components with appropriate materials.

Periodic re‑calibration, especially after module replacement.

Assigning clear responsibility (in‑house facilities vs external service) avoids “orphaned” installs that quietly degrade.

Managing modules, power supplies and control systems over a 5–7 year lifecycle

Over a typical lifecycle:

Expect some module and PSU replacements; keeping labelled spares is critical.

Plan for at least one control system update, especially if you intend to integrate new content formats or data feeds.

Monitor power consumption over time; unexpected jumps may indicate cooling or component issues.

Content refresh strategies to keep holographic installations performing commercially

From a commercial standpoint, content must evolve:

Establish a calendar: product launches, seasonal events, brand campaigns.

Mix evergreen motion design with campaign‑specific layers.

Test new content on smaller sections before rolling out to large façades.

For multinational brands, centralised content guidelines combined with local adaptation work well, especially when vendors offer templated content structures.

Market Outlook to 2030: Adoption Trends and Future of Holographic Displays

Global holographic display market size and growth forecasts for key verticals

Industry research suggests the global holographic display market already sits in the multi‑billion‑dollar range, with a strong CAGR through 2030 driven by:

Retail digitalization and DOOH upgrades.

Smart city projects and transport hubs.

Entertainment, sports and live events.

Several 2025 reports point to retail and media façades as the fastest‑growing segment for transparent and holographic LED, outpacing classic LED billboards in percentage growth.

Technology roadmap: finer pixel pitch, higher transparency and integration with interactive tech

Technically, we can expect:

Finer pixel pitches for closer‑viewed holographic windows.

Improved LED-on-film processes for even more “invisible when off” glass.

Tighter integration with sensors, AI engines, and AR backends.

Companies that already handle transparent LED, holographic grids, and crystal film—such as those described at resources like https://en.zmleds.com/l—are well positioned to combine these into hybrid solutions.

Will LED holographic screens replace traditional displays or coexist with them?

To return to the original question: is an LED holographic screen the future of display technology? For most environments, it will coexist:

It will not replace every indoor screen, control room wall, or price board.

It will increasingly dominate high‑impact, architecture‑integrated storytelling zones.

The “future” is not a single screen type, but an ecosystem where holographic LED plays the role of spatial, immersive, see‑through canvas.

FAQs on LED Holographic Screens for Business Decision‑Makers

Can LED holographic screens be used outdoors and in bright environments?

Yes, provided the product is designed for high brightness and suitable IP rating, and the content is optimized for contrast. For direct sun façades, involve the manufacturer early to validate brightness, structural and thermal design.

Do holographic LED installations always require custom 3D content?

Not always, but to unlock the holographic effect you need at least some content designed with depth and perspective in mind. Many teams start with a mix of adapted 2D assets and a few high‑impact 3D hero scenes.

What project sizes and budgets typically justify investing in holographic LED displays?

They make the most sense where footfall is high, brand value is significant, and glass area is substantial—flagships, airports, landmark malls, museums. Smaller retail can still use compact holographic fans or small transparent panels, but should be clear on measurable objectives.

Conclusion

LED holographic screens are not a gimmick anymore; they are a mature, if still evolving, tool for turning glass and space into active media. They make sense where transparency, immersion, and architecture are central to the experience, and where uplift in dwell time, brand perception and conversion can justify a higher investment than a simple LCD. If you’re evaluating a project, start with a clear objective, survey your space, request realistic mockups, and work with a vendor that understands both optical engineering and content, not just panel pricing.

References

MarketsandMarkets, “Holographic Display Market – Global Forecast to 2030”.

SID (Society for Information Display) technical papers on transparent and emissive display technologies.

IEC and local standards on LED display safety, EMC and environmental performance.