description: A practical 2025 buyer’s guide to mesh, film and holographic LED transparent displays for retail. Learn specs, use cases, costs, risks and how to pick the right solution for your stores.

Finding the right LED transparent holographic advertising display for a store often feels like renovating the shopfront with the doors still open: you must attract more traffic without blocking views, comply with mall rules, and keep the project budget under control. Over the past few years I’ve seen retailers jump straight to “cool hologram” demos, then realise later that brightness, glass load, and content workflows matter more than the initial wow. With transparent LED mesh, film and several holographic formats now on the market, the real question is no longer “Does it look stunning?” but “Will it stay readable at 3 pm sunlight, work with our IT and actually lift sales?” So let’s answer the questions that usually land on the table: which type fits your storefront, what specs are non‑negotiable, and how do you avoid buying an impressive but unusable showpiece.

Best Transparent Holographic LED Options for Retail

- For large glass façades and high‑brightness street fronts, transparent LED mesh is usually the most robust choice.

- For clean, minimal shop windows and curved glass, transparent LED film is better when you want the glass to remain almost unchanged.

- For immersive 3D storytelling in hero zones, a holographic LED screen is the right tool, not a general signage replacement.

- P‑series fully transparent holographic screens work best on fixed windows and curtain walls where you want content to “float” in the air.

- A‑series floor‑standing holographic displays suit flexible campaigns, pop‑ups and seasonal promotions that move between stores.

- M‑series modular holographic displays are designed for larger, high‑impact retail projects where you need custom sizes and higher performance.

- If your store faces strong daylight, prioritize brightness (often 3000–5000 nits) over extreme transparency to keep content actually visible.

- To shortlist solutions, map three things first: viewing distance, daylight level and whether the glass must remain visually open for merchandisers.

What Is an LED Transparent Holographic Advertising Display?

Core concept: From transparent LED display to holographic retail screen

In engineering terms, an LED transparent display is simply a grid of LEDs on a see‑through structure (mesh, glass or film) that lets most natural light pass through. A holographic advertising display builds on that idea: content is designed to float in front of products or inside a window, while shoppers can still see the physical merchandise behind it.

Retailers like this format because it solves a long‑standing conflict: traditional LED walls give impact but turn the shop into a black box. Transparent LED displays keep the store visually open, keep mannequins or product shelves visible, and still carry dynamic messaging.

In practice, most “holographic LED screens” used in retail are highly transparent LED structures combined with specific content (high contrast, dark backgrounds, 3D motion cues) rather than true volumetric holograms. The value comes from the perception of depth and floating objects when you look through the glass.

How transparent holographic LED displays create floating visual effects

Technically, the effect relies on three layers:

1) The LED plane itself – a transparent substrate (mesh frame, film, or slender modules) where LEDs are spaced to allow 60–90% light transmission.

2) The background – your store interior, products, or a dark space behind the screen.

3) The content – graphics designed with lots of negative (dark) areas so the eye focuses on bright elements “hanging” in space.

When you combine high transparency (often 70–80%), sufficient brightness and the right viewing distance, the human eye merges these layers. A shoe spinning in mid‑air above a physical podium or a perfume bottle seemingly pouring light into a real display table is just LEDs on glass plus clever content timing.

Expert tip: “If you want the holographic illusion to work, design dark‑background content first, then worry about colors. Bright full‑frame videos kill the floating effect and just turn your window into a normal LED.”

Transparent vs holographic vs traditional LED walls: what really changes for retail

From a retail operations perspective:

Traditional LED walls:

Pros: very bright, high resolution, works anywhere.

Cons: blocks views, heavy, usually intrusive in shopfronts.

Transparent LED displays (mesh or film):

Pros: keep visibility into the store, lighter, easier to integrate into glass.

Cons: lower pixel density, content must be optimized for the gaps.

Holographic LED screens:

Pros: strongest “wow” factor, 3D illusions, ideal for hero campaigns.

Cons: more sensitive to content quality, not always ideal as the only signage tool.

For retail, the right question is not “transparent or holographic”, but “where do I need high‑impact 3D storytelling, and where do I just need clear, reliable digital signage on glass?”

Main Types of Transparent LED Displays Used in Retail

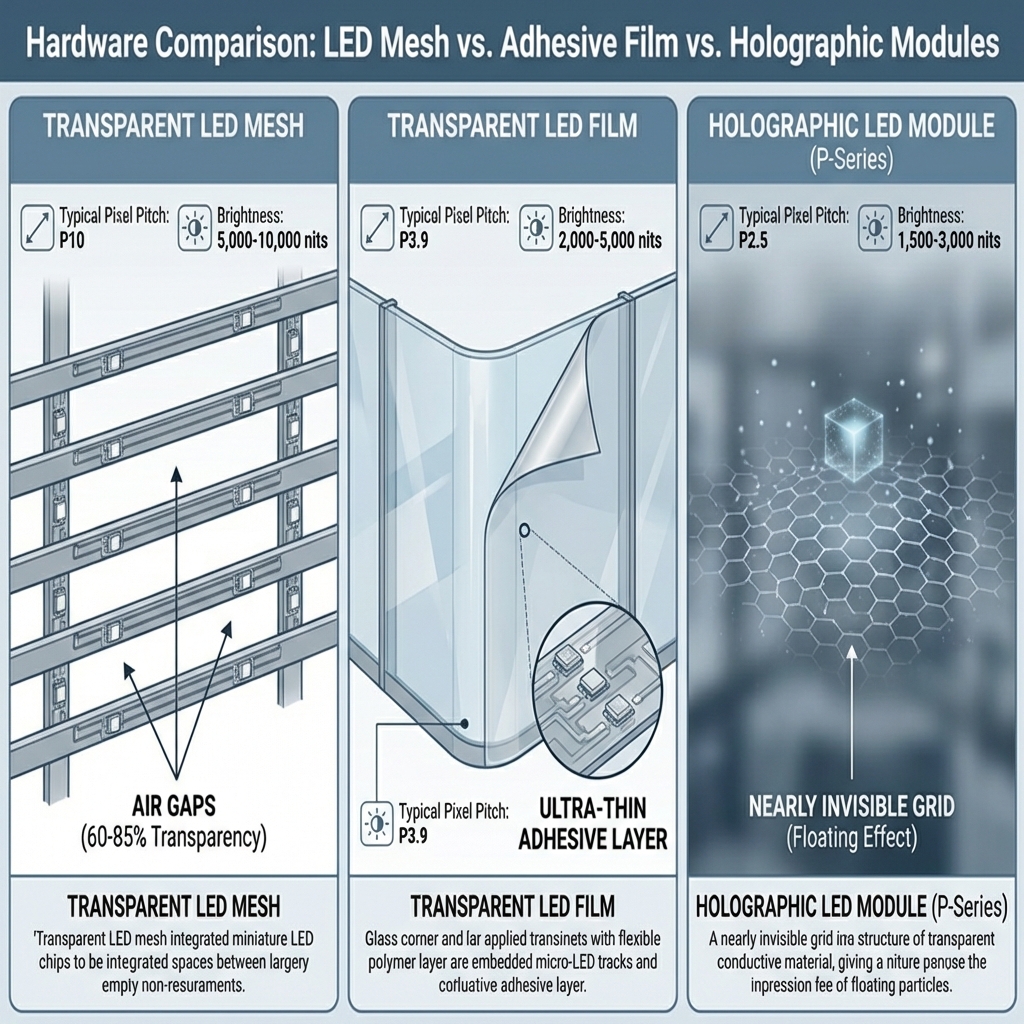

Transparent LED mesh screens for large retail façades and glass walls

Transparent LED mesh is built from slim horizontal or vertical bars with LEDs mounted along the surface. The gaps between bars create transparency and reduce wind load and weight. Typical transparency for retail solutions ranges from 60% to over 80%, depending on pixel pitch and bar design.

Mesh suits:

- Large street‑facing windows in fashion chains or electronics stores.

- Multi‑storey glass façades in malls.

- Locations where structural load and ventilation are a concern.

Because the LED components are separated by air, mesh can handle higher brightness levels (3000–7000 nits) without trapping too much heat against the glass. That makes it a strong choice for south‑facing or outdoor applications.

Transparent LED film and glass for shop windows and curved surfaces

Transparent LED film takes a different approach: ultra‑thin LED circuits are embedded in a clear, adhesive film that is laminated or stuck directly onto glass. The result is extremely lightweight, with very little visual impact when the display is off.

Retail advantages:

- Ideal when the architect or landlord insists the glazing stays clean and minimal.

- Good for curved windows, corners and irregular surfaces.

- Easy to retrofit on existing glass without heavy frames.

Because LED film prioritizes transparency and thinness, pixel pitch is usually coarser, and brightness is often limited compared to mesh. It excels in indoor environments or shaded malls where you don’t fight direct sun.

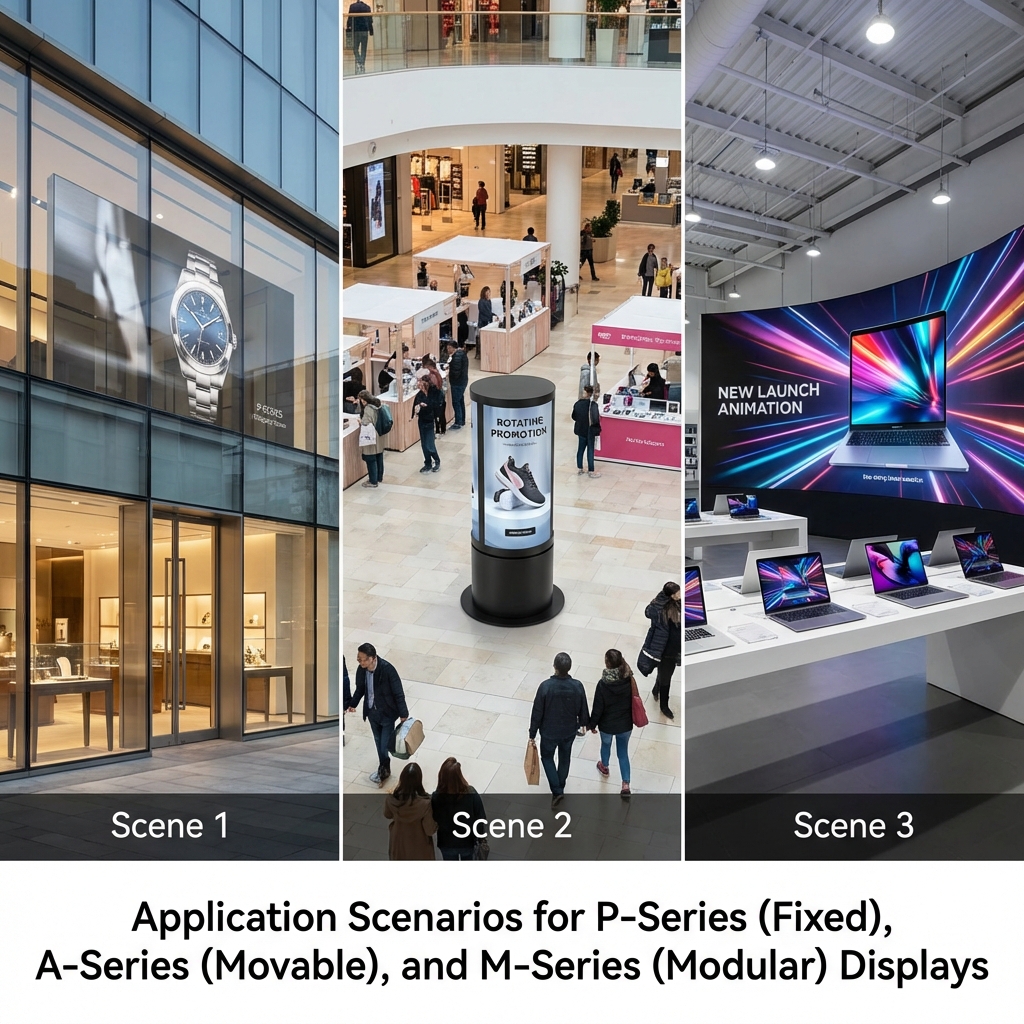

Holographic LED screen series for immersive retail advertising (P, A, M examples)

In many projects, the truly “holographic” experience comes from dedicated holographic LED screen families rather than generic mesh or film. Zhenmei Wisdom, for example, offers several series that illustrate how these systems are engineered for different retail uses:

P Series LED holographic screens focus on fully transparent, invisible modules that sit on glass or in front of windows. With pixel pitch around P3.9, 80% visual transparency and brightness around ≥2000 cd/m², they suit fixed window advertising where you want content to appear suspended without blocking daylight.

A Series LED holographic screens are plug‑and‑play, floor‑standing units – effectively self‑contained holographic totems. They share similar pixel pitch (P3.9) and 80% transparency, but with higher brightness (≥3000 cd/m²) for busy indoor malls and atriums.

M Series LED holographic screens are high‑performance modular units designed for larger creative canvases, with pixel pitches ranging from P2.5 to P10, transparency between 70–90% and brightness up to 5000 cd/m². These can be assembled into customized holographic walls or shapes.

These three types show how “holographic LED screen” is not one product, but a family of transparent display structures optimized for specific retail environments and integration methods.

Mesh vs Film vs Holographic LED: Detailed Comparison for Storefronts

Side‑by‑side comparison: transparency, brightness, pixel pitch, viewing distance

A practical way to think about LED transparent holographic advertising displays is by the numbers:

- Transparency:

- Mesh: 60–85%, depending on pitch and bar design.

- Film: up to 90% in some products.

- Holographic modules (e.g., P & M series): typically 70–80%.

Industry data: typical transparency for retail‑oriented transparent LED solutions is in the 60–90% range, with higher transparency often trading off against pixel density (2024 product specs).

Brightness:

Indoor windows and malls: 2500–3500 nits is usually sufficient.

Street‑facing or semi‑outdoor glass: plan for 3500–7000 nits.

Holographic series like M often sit in the 2000–5000 nits window depending on pitch.

Pixel pitch & viewing distance:

P2.5–P3.9: good for 3–6 m viewing.

P6.25–P10: more suitable for 8–15 m and above.

Film displays often land around P5–P10 equivalent; mesh can vary widely.

If your shoppers stand at 3–4 m from the glass, a P2.5–P3.9 product (like many holographic modules) feels crisp. If they’re 10 m away across a mall corridor, P6 or even P8 can be perfectly acceptable and more cost‑effective.

Installation flexibility, weight and structural impact on existing store windows

For existing stores, installation constraints often dictate type:

Mesh:

Requires fixing points at top/bottom or sides.

Adds visible structure but keeps weight manageable.

Good where you can mount inside the glass frame or on a secondary support.

Film:

Minimal structure, directly applied to glass; very light.

Almost no impact on frames, ideal when building rules are strict.

Needs careful handling during application and reliable power/data routing at edges.

Holographic LED (P/A/M series):

P Series modules can integrate with curtain walls or window frames; structural planning is needed but visual impact can be very clean.

A Series floor‑standing units avoid touching the glass at all – great for leased spaces or pop‑ups.

M Series modules usually need a designed frame or metalwork; best handled by system integrators or experienced contractors.

From a facilities point of view, film is the least intrusive; A Series‑style floor units require almost no building work; large mesh or M Series holographic walls may need load checks and cable routing plans approved by the mall.

Content performance: 2D advertising, 3D illusion and interactive experiences

Different transparent LED types handle content differently:

Mesh and film:

Excellent for 2D advertising, branding loops, promos and simple animations.

Can create a mild depth effect, but the core value is dynamic messaging on glass.

Interactive elements are typically driven via cameras or sensors on separate hardware.

Holographic LED screens:

Shine when you design specifically for 3D illusion: rotating products, particle trails, layered typography.

Good choice for hero SKUs, collection launches or XR‑style experiences.

When combined with sensors or mobile triggers, they can respond to passer‑by motion or app interactions.

If you need a primary digital poster system for price‑driven retail, mesh or film may give a better cost‑performance ratio. If the brand playbook calls for “Instagrammable windows” and storytelling, a holographic LED series deserves a dedicated line in the project budget.

Engineering Fundamentals: How Transparent and Holographic LED Displays Work

LED layout, substrates and optical paths behind transparent LED mesh and film

At the hardware level, the differences among transparent LED display types lie in how they build the optical path:

- Mesh: LEDs are mounted on linear PCBs or strips, with open space between them. Light from behind passes between the strips; light from the LEDs goes forward to the viewer.

- Film: micro‑LEDs and conductors are embedded in or printed on a transparent polymer, keeping the visible lines as thin as possible. The substrate itself carries light through.

- Holographic modules: use very slim frames or grid structures, engineered to “disappear” when viewed from normal angles, so content appears detached from any frame.

The optical goal is the same: maximize LED luminous area while minimizing blocking of the background, so your eye perceives graphics floating in a real environment.

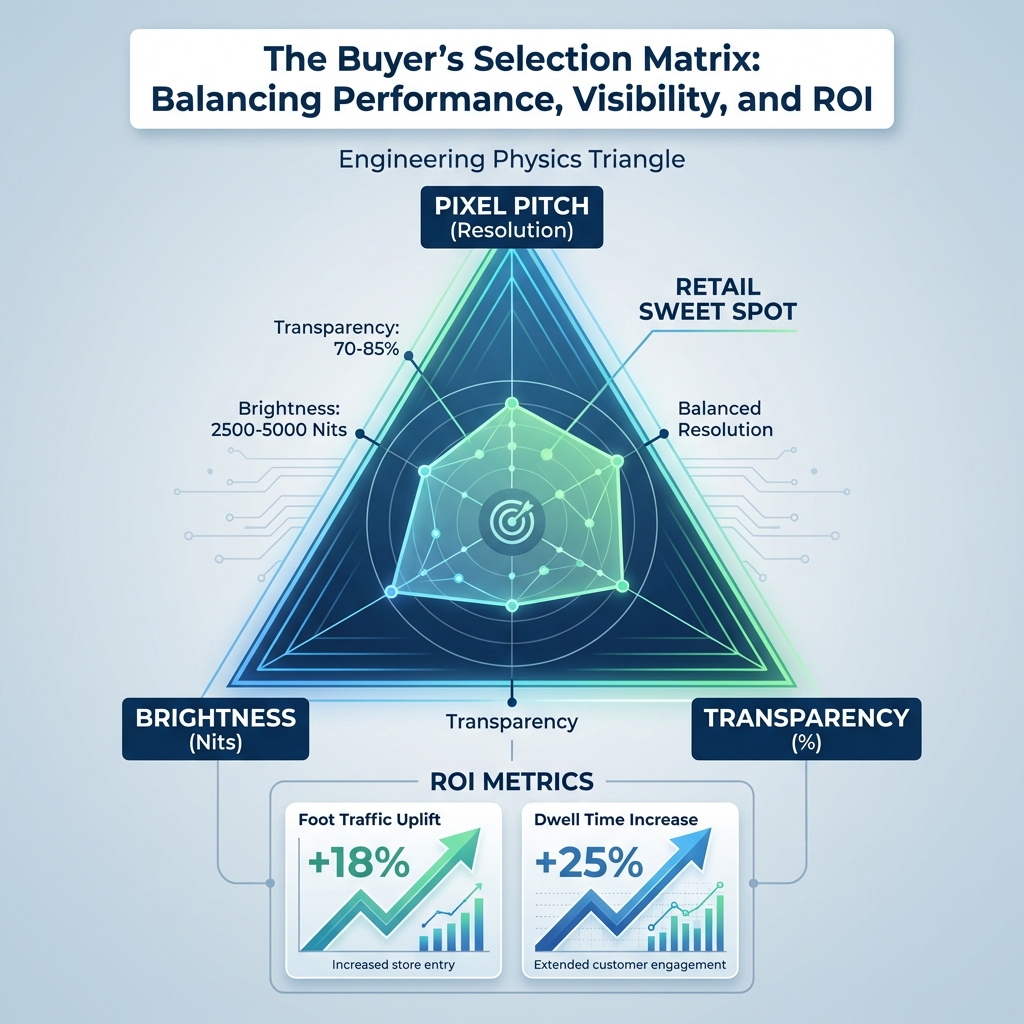

How pixel pitch, nit levels and transparency percentage interact in real stores

There’s a physics triangle that every project owner should keep in mind:

- Smaller pixel pitch = more LEDs per square meter.

- More LEDs = more light (good) but also more visible structure (lower transparency) and more power/heat.

- Higher brightness (nits) is easier to achieve when LEDs are spaced out (mesh), but that can hurt perceived resolution at close range.

In a typical store window:

- If you push pixel pitch too fine (say P2.5) and also ask for 90% transparency, the engineering team has to make trade‑offs – usually by reducing brightness or mechanical robustness.

- If you accept 70–80% transparency, you gain flexibility to increase brightness to the 3000–5000 nits range and keep a stable structure.

Practical rule of thumb: for retail windows, 70–85% transparency with 2500–5000 nits brightness gives a more reliable result than chasing 90%+ transparency on paper.

Limits and trade‑offs: why you cannot maximize brightness, resolution and invisibility at once

No supplier can honestly give you maximum brightness, ultra‑fine resolution and near‑invisible hardware all at the same time on a single pane of glass. The constraints are:

- Thermal: more LEDs and more power mean more heat near the glass.

- Structural: ultra‑slim frames look great but limit module size and mounting options.

- Visual: extreme transparency means fewer LEDs, which limits how much light you can emit.

A mature vendor will guide you through these trade‑offs for your specific store type, instead of simply promising “95% transparency” and “5000 nits” in the same sentence without context.

Retail Use Cases: Matching Display Types to Real Store Scenarios

Storefront windows and street‑facing displays: choosing between mesh, film and holographic

For most chains, the shop window is the highest‑value digital real estate. The choice often breaks down as:

Strong daylight, medium to long viewing distance (5–20 m):

Transparent LED mesh or M‑series‑type holographic modules with higher brightness win.

Focus your specs on nits and robustness.

Indoor mall windows with moderate light and close viewing distance (2–6 m):

Transparent LED film or P‑series transparent holographic screens work well.

Optimize for pixel pitch and visual neatness of the glass.

Premium or flagship windows with a focus on experience rather than pure promo density:

Combine a holographic screen in the center (for hero storytelling) with simpler mesh/film strips for price and promo content around it.

Indoor retail signage and digital product walls

Inside the store, transparent LED displays become more of a design tool:

- Transparent walls between zones can show digital content while still letting staff see through.

- Product walls behind counters can run dynamic animations without turning the area into a dark corner.

- For pop‑up booths within malls, free‑standing holographic units like A Series can be positioned where traffic is highest, independent of glazing.

Here, daylight is lower, so you can use lower brightness ranges and focus more on resolution and content flexibility.

Flagship stores, luxury boutiques and brand experiences with holographic LED

Luxury and flagship environments are where full holographic LED setups justify their cost:

- Floating products above physical plinths.

- Storytelling sequences that transition between seasons or capsule collections.

- “Portal” style windows where shoppers feel like looking into another world rather than a simple display.

In those projects, M‑series‑style modular holographic screens with higher brightness and flexible pixel pitch are often combined with architectural lighting and spatial sound. The LED transparent display becomes part of a larger brand experience, not just a digital poster.

Technical Selection Criteria for Retail Buyers

Pixel pitch and viewing distance: how P2.5, P3.9, P6.25 and above affect image quality

From a buyer’s perspective, pixel pitch is the spec that most directly affects how “premium” your window looks:

P2.5–P3.9:

Crisp logos, product renders and text down to ~24 pt at 3–4 m.

Ideal for fashion, cosmetics, jewelry and premium electronics.

P6.25–P10:

Perfectly fine for big visuals, logo blocks and pricing at 8–15 m.

More cost‑effective per square meter, better for very large façades.

Actionable advice: map your primary viewing distances (corridor width, sidewalk distance) and insist that vendors simulate your content at that distance using the proposed pixel pitch.

Brightness, transparency and contrast: choosing nit levels for indoor vs outdoor windows

Brightness is measured in nits (cd/m²). Typical guidance:

- Indoor mall or shaded windows: 2500–3500 nits is often enough.

- Street‑facing, sunny environments: plan from 3500 up to 5000+ nits, especially if dark backgrounds are used.

- For holographic illusions, contrast matters as much as brightness: make sure the display can dim at night without washing out blacks.

Transparency and brightness interact. If a product like Zhenmei Wisdom’s P Series offers around 80% transparency at ≥2000 nits, that already suits many indoor windows. For tougher environments, an M Series configuration at 3000–5000 nits and 70–80% transparency may be more appropriate.

Color accuracy, refresh rate and grayscale performance for high‑end branding

High‑end brands care about consistency:

- Color accuracy: look for calibration capabilities and a trusted LED binning process; ask to see brand‑color test images.

- Refresh rate: for cameras and social media sharing, 3840 Hz or above reduces flicker in phone videos.

- Grayscale: higher grayscale levels (e.g., 14–16 bit) help subtle gradients, especially in skin tones and product shots.

These specs are often buried in datasheets; they matter most when you expect a lot of user‑generated content or plan to film campaigns in front of the displays.

Series Selection Guide: Choosing Between P, A and M Holographic LED Screens

P Series: fully transparent fixed installations for windows and curtain walls

P Series holographic LED screens are built for permanent, fully transparent installations:

- Pixel pitch: typically around P3.9 – a sweet spot for 3–6 m viewing.

- Transparency: around 80%, so your window remains visually open.

- Brightness: ≥2000 cd/m², suitable for many indoor or semi‑indoor retail situations.

They make sense when:

- You own or long‑term lease the storefront.

- You want your main glazing to double as a “floating” digital canvas.

- You are ready to coordinate with façade contractors for integration.

A P Series‑style solution on a flagship window often becomes a long‑term asset, not a campaign tool that moves around.

A Series: plug‑and‑play floor‑standing holographic displays for flexible retail campaigns

A Series holographic screens trade structural integration for flexibility:

- Floor‑standing, plug‑and‑play form factor.

- Pixel pitch around P3.9, transparency about 80%.

- Higher brightness (≥3000 cd/m²) to stand out in busy mall corridors.

These suit:

- Seasonal campaigns that rotate between stores.

- Pop‑up concepts inside malls or department stores.

- Retailers who cannot modify glass or building structure.

Because A Series units are self‑contained, they are easier to deploy via marketing budgets, with minimal involvement from construction teams.

M Series: modular high‑performance holographic displays for large‑scale retail projects

M Series holographic LED screens are the workhorses for large, creative projects:

- Pixel pitch options: P2.5 / P3.91 / P6.25 / P8 / P10.

- Transparency: adjustable via configuration, typically 70–90%.

- Brightness range: roughly 2000–5000 cd/m².

They are ideal when:

- You need large, customized holographic surfaces.

- The design calls for unconventional shapes or huge atrium installations.

- The project involves professional system integrators and dedicated content production.

For such projects, it’s worth reviewing detailed specs and examples (for instance, the M Series overview on Zhenmei Wisdom’s site) and aligning with architects early to avoid rework later.

Installation, Integration and Maintenance in Retail Environments

Glass, frames and cabling: what your store needs before installing transparent LED

Before choosing a product, confirm:

- Glass type and load capacity – especially for large mesh or modular holographic systems.

- Available fixing points and whether the landlord allows drilling or frame changes.

- Cable paths for power and data; retail teams often underestimate how visible loose conduits can look from outside.

For A Series‑style floor units, you mainly need a safe power outlet and a clear zone around the unit. For P and M Series, involve facilities and, when required, a structural engineer.

Control systems, content management and integration with existing digital signage

From an IT and operations standpoint:

- Check whether the transparent LED system integrates with your existing CMS or needs a dedicated controller.

- Decide who will manage content playlists – central marketing, local store, or an external agency.

- Plan for remote monitoring of brightness, errors and temperature; this matters for multi‑store deployments.

Implementation tip: agree upfront on who “owns” brightness schedules and content approvals; unclear ownership is the main reason high‑end windows end up running outdated or inappropriate loops.

Cleaning, routine inspection and module replacement for long‑term reliability

In daily retail life:

- Housekeeping must know how to clean glass and displays without scratching substrates or damaging seals.

- Technicians should perform regular checks for loose connectors, damaged strips or hot spots.

- For modular systems, ask vendors to document how to swap a single module without disassembling an entire window.

A good rule is to align maintenance intervals with existing store checks (e.g., quarterly safety inspections) to keep effort predictable.

Cost and ROI: Evaluating Transparent Holographic LED for Retail Investment

Cost structure breakdown: hardware, installation, content production and operation

Total project cost goes beyond the LED panels:

- Hardware: mesh/film/holographic modules, controllers, mounting hardware.

- Installation: scaffolding or lifts, metalwork, glass treatment, permits.

- Content: one‑off production of holographic campaigns; ongoing adaptation for promotions.

- Operation: power consumption, maintenance visits, occasional module replacement.

Transparent mesh and film are usually cheaper per square meter than high‑end holographic systems; however, a single, well‑placed holographic screen can sometimes replace multiple conventional lightboxes in terms of impact.

Typical price ranges for mesh, film and holographic LED retail projects

Exact prices vary regionally, but a simplified pattern is:

- Transparent LED film: lower to mid cost per square meter; ideal when you must cover many smaller windows.

- Transparent LED mesh: mid range, particularly for large areas.

- Holographic P/A/M Series‑type systems: higher per square meter due to structure and content expectations, but not always dramatically higher on small hero installations.

When planning, separate “always‑on background signage” from “hero experience zones” and budget them differently. It’s common to mix film or mesh for broad coverage and a compact holographic unit for hero storytelling.

How to estimate ROI: foot traffic uplift, conversion rate and brand impact

To justify investment internally, define metrics before buying:

- Foot traffic uplift at the store entrance (use simple people counters).

- Conversion rate and average basket size during campaigns with holographic content.

- Dwell time around hero zones compared to static displays.

Practical approach: run an A/B test between two similar stores – one with transparent LED holographic display, one without – over the same campaign period, then compare traffic and sales deltas rather than relying on impressions alone.

Over 12–24 months, retailers typically see ROI when they fully use the system for seasonal campaigns, price promotions and brand storytelling, not just one launch event.

Common Misconceptions, Risks and How to Avoid Bad Purchases

Myths about transparency percentage, brightness and “hologram” effects

Three myths show up repeatedly:

“Higher transparency is always better.”

Too much transparency can make content washed out, especially in bright environments.“More nits solve everything.”

Excess brightness at night can cause glare, annoy neighbours and violate regulations.“Any transparent LED is a hologram.”

Without appropriate content and background conditions, you simply get semi‑transparent video, not a holographic effect.

The right balance depends on your store’s actual light conditions and the kind of stories you want to tell.

Hidden risks: overload on glass, heat, glare and local regulations

Risks that often appear late in projects:

- Load: adding heavy frames to old glass can exceed design tolerances. Always check load calculations.

- Heat: high‑brightness systems close to glass can raise local temperatures; consider ventilation.

- Glare: very bright windows may disturb residential neighbours or drivers. Some cities regulate digital brightness and operating hours.

Engage building management and, if needed, local authorities early, especially for big street‑facing installations.

Vendor due diligence: what specs and certifications to request before ordering

Before signing a contract, ask vendors to provide:

- Detailed datasheets with pixel pitch, brightness range, transparency, refresh rate, and power consumption.

- Certification documents (e.g., safety and EMC standards relevant to your market).

- Real photos or videos from installed retail projects, not only renderings.

- A clear maintenance and support plan with SLA terms.

Vendors with strong R&D and manufacturing capabilities, like integrated manufacturers in Shenzhen, should be able to back up claims with lab data and case studies rather than pure marketing language.

Advanced Content and Operation Strategies for Retailers

Designing effective content for transparent and holographic retail displays

Good content often matters more than the last 10% of hardware spec. For transparent LED:

- Use dark backgrounds to let the physical store show through.

- Avoid tiny text and overly detailed patterns; think bold shapes and clear focal points.

- For holographic LED screens, design 3D‑style motion – rotation, parallax, depth layers.

Seasonal campaigns, dynamic pricing and real‑time promotions on transparent LED

One advantage of digital storefronts is agility:

- Swap seasonal campaigns without reprinting and re‑installing large posters.

- Show time‑based offers (lunchtime bundles, evening promotions) in city centers.

- Adapt content to local events, weather or traffic patterns.

Transparent LED displays can integrate with the same CMS you use for indoor digital signage, keeping operations manageable for central teams.

Data‑driven optimization: A/B testing visuals and measuring campaign performance

To move beyond “looks great”:

- Test different content variants in similar stores or time slots.

- Measure uplift in entry rate, category sales and cross‑selling during each creative.

- Keep a simple dashboard of “creative vs key metrics” so marketing teams learn what works on transparent and holographic canvases.

Over time, this feedback loop often yields more value than upgrading to slightly higher brightness or finer pixel pitch.

Future Trends in Retail Digital Window Displays and Holographic Tech

Thinner substrates, higher transparency and flexible LED films

R&D is pushing LED transparent display tech towards:

- Thinner, lighter films that feel almost like standard window laminates.

- Higher transparency without sacrificing too much brightness, thanks to improved LED efficiency.

- More flexible substrates, allowing LED film to wrap around curves and corners seamlessly.

For retailers, that means future retrofits will be less intrusive and more design‑friendly.

Interactive retail: combining sensors, mobile and holographic content

Interactive experiences are gradually moving from flagship experiments into mainstream:

- Motion sensors triggering content when people pass by.

- Mobile integration where AR or coupons sync with holographic displays.

- Simple gesture‑based interactions for hero products.

Transparent holographic LED screens are particularly well‑suited to these experiences because the product remains visible behind the content.

Sustainability, energy efficiency and evolving standards in store display technology

Energy and sustainability questions now appear in almost every RFP:

- LEDs are already more energy‑efficient than many older lightbox and LCD solutions, but large surfaces still draw significant power.

- Expect more standards and best practices around brightness caps, automatic dimming and sustainable materials.

- Manufacturers with in‑house R&D are investing in higher‑efficiency LEDs and smarter power management.

Retailers planning multi‑year rollouts should include energy usage and lifecycle in their evaluation checklists.

FAQs About Transparent Holographic LED Displays for Retail

What is the best transparent LED display for retail advertising today?

There is no single “best” option; mesh suits large, bright windows, film suits minimal or curved glass, and holographic LED screens are best as high‑impact hero canvases. The right answer depends on your viewing distance, daylight level and brand priorities.

Can transparent holographic LED screens work in bright sunlight or outdoor windows?

Yes, but you must choose a system with sufficient brightness (often 3500–5000 nits or more) and accept slightly lower transparency to support that output. Content with strong contrast also helps readability in daylight.

How long do transparent LED and holographic displays last in continuous retail use?

Quality transparent LED modules typically offer lifetimes of 50,000 hours or more under proper thermal management and maintenance. In daily retail use, that often translates into several years of operation before noticeable brightness decay.

Conclusion

Transparent LED and holographic advertising displays have moved from gimmick to practical tool for retail windows and interiors, but only when matched carefully to store conditions. For day‑to‑day promotional coverage, transparent mesh or film can turn your glass into a dynamic, yet open, canvas. For high‑impact storytelling and flagship experiences, dedicated holographic LED series – such as P for fixed transparent windows, A for movable floor‑standing campaigns and M for larger modular canvases – provide the depth and “floating” visuals that stop people in their tracks.

If you’re shortlisting solutions, start with three simple steps: define viewing distances and daylight conditions for each window, decide where you truly need holographic impact versus basic digital messaging, and involve both marketing and facilities early in the conversation. With that groundwork, vendor discussions become much more concrete and you avoid investing in impressive hardware that doesn’t fit your actual stores.

References

- “Transparent LED Display Film: The Ultimate Guide”, Holoscape LED, 2024.

- “3 Minutes to Know Transparent Holographic LED Screen”, UNIT LED, 2025.

- Various transparent LED mesh and holographic display product datasheets and retail project specifications, 2023–2025.