Description: A practical 2025 buyer’s guide to LED holographic screen applications across industries, covering technology, ROI, risks and supplier selection for retail, museums, corporate, hospitality and event projects.

I often tell clients that choosing a new display technology is a bit like redesigning your store layout while customers are already walking in: you don’t get many chances to get it right, and every mistake is public. LED holographic screens look spectacular in videos, but in real projects you’re juggling real-world issues—sunlight on glass façades, safety codes, conservative finance teams and marketing’s demand for “something immersive”. At the same time, digital signage budgets are growing and the pressure to prove that every square meter of glass brings measurable value is much higher than it was even three years ago. So the questions I hear from procurement managers and brand leads are pretty consistent: where do LED holographic screens genuinely work better than conventional LED walls, what kind of ROI can you realistically expect in different industries, and how do you avoid buying an eye‑catching prototype that becomes a maintenance headache?

Where LED Holographic Screens Create the Most Value

- LED holographic screens use transparent LED structures to overlay dynamic content on glass while keeping visibility and daylight, ideal for retail, museums, corporate and hospitality spaces.

- The strongest ROI appears in high‑traffic retail storefronts, mall atriums, airports, museums and trade shows where attention and dwell time directly impact revenue or sponsorship.

- They outperform traditional LED walls where transparency, lightweight structure and integration with existing glass façades are critical.

- They are not the best choice when you need ultra‑fine pixel pitch at very close viewing distances or in extremely bright south‑facing outdoor façades without shading.

- Typical transparency ranges from 70–90%, allowing spaces to remain visually open and compliant with many building and safety requirements.

- Energy consumption is usually 20–40% lower than some legacy digital signage, which improves total cost of ownership over multi‑year deployments.

- Success depends heavily on tailored content—3D‑style motion, calibrated brightness and smart scheduling—not just on the hardware itself.

- For first‑time buyers, starting with a pilot on one façade or one flagship venue is often the safest route to validate assumptions and build an internal ROI case.

Understanding LED Holographic Screens and Transparent Displays

How LED holographic and transparent LED screens actually work

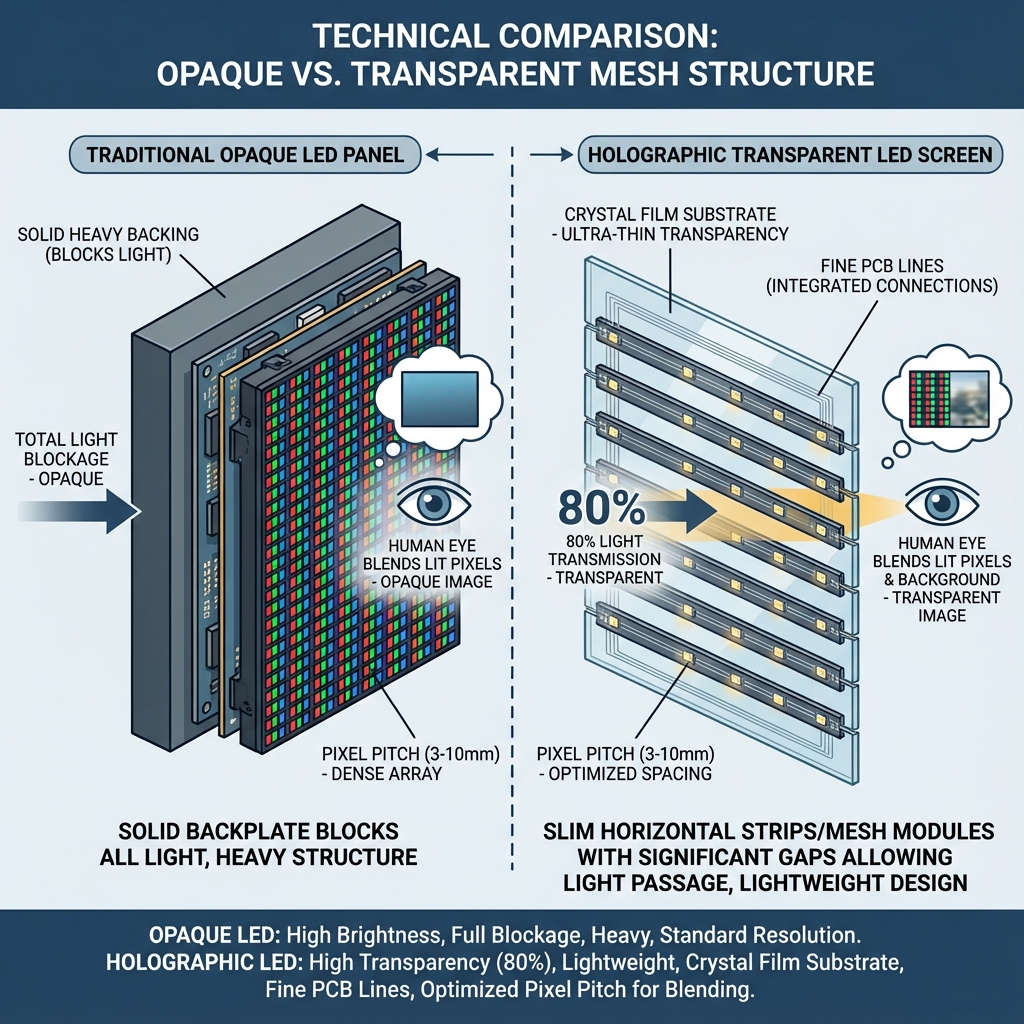

In practice, most “LED holographic screen” projects you see in commercial spaces are advanced transparent LED displays rather than science‑fiction volumetric holograms. The holographic feel comes from how content floats on glass while people still see the environment behind it.

Structurally, these systems use slim LED strips or mesh modules arranged in a grid, with gaps between the LED lines. When mounted on or close to glass, the human eye blends the lit pixels into images, while the gaps let daylight and views pass through. With proper design, you get 70–90% light transmission.

From a control perspective, they operate like other LED systems: a controller receives video input (from media players, CMS or live feeds), maps it to the pixel layout and handles brightness, color and timing. What makes them feel different is:

- Transparent support structure (often clear film, mesh frames or fine PCB lines)

- Thin, lightweight modules that conform to curved glass or complex façades

- Content designed with negative space, leveraging transparency as part of the composition

Companies like Zhenmei Wisdom work a lot at this layer—optimizing transparent LED modules, crystal film screens and flexible screens so integrators can treat glass as a dynamic but still functional building element.

Key components, materials and structural design of holographic LED systems

From an engineering point of view, you’re usually dealing with:

- LED modules or film: high‑brightness SMD or similar LEDs mounted on transparent substrates or thin frames.

- Structural frame: aluminum or steel framing fixed to mullions, curtain walls or dedicated brackets; must account for wind load, thermal expansion and access.

- Power and data lines: concealed in mullions or side channels to keep the “floating” appearance.

- Control system: sender/receiver cards, media player, CMS, network integration.

- Thermal management: passive airflow or, in dense installations, dedicated ventilation behind glass to keep temperatures within LED specs.

On crystal film and ultra‑thin solutions, adhesion and long‑term stability on glass become critical. In older buildings, you often need a secondary frame to avoid drilling or overloading the original façade.

LED holographic screens vs traditional LED walls vs transparent OLED

Many buyers first ask “Why not just install a normal LED wall?” It’s a fair question.

Traditional LED walls:

Pros: High brightness, wide viewing angles, flexible pixel pitches, strong impact for opaque backdrops.

Cons: Block light and views, heavier structures, more intrusive to architecture, may trigger stricter planning or safety constraints.

Transparent OLED:

Pros: Superb contrast and color, truly see‑through panels, very fine resolution, excellent for premium indoor close‑up viewing.

Cons: Higher cost per m², lower brightness than high‑end LEDs, more sensitive to ambient light and burn‑in, sizes and shapes more limited.

LED holographic / transparent LED screens:

Pros: Very high brightness, large custom sizes, curved or irregular shapes, lightweight, high transparency, can be added to existing glass with minimal structural reinforcement.

Cons: Pixel pitch is coarser (typically several millimeters), content must be designed for viewing distances of several meters, and the 3D “holographic” effect depends heavily on creative work.

For large façades, atriums, and long viewing distances, transparent LED generally wins on practicality and cost. For small, ultra‑premium indoor showcases at arm’s length, transparent OLED may still be the better option.

Core Performance Metrics and Technical Advantages for Commercial Projects

Transparency, brightness and visual impact in high‑ambient light environments

Commercial teams love the “floating” visuals; engineers worry about numbers. Some of the key metrics you should look at:

- Transparency: 70–90% light transmission is typical. Higher transparency generally means fewer LEDs and lower resolution, so there is a trade‑off.

- Brightness: For indoor atriums, 1500–3000 nits are usually sufficient; for sun‑exposed glass, 4000–6000 nits or higher may be required.

- Pixel pitch: Often in the 3–10 mm range. For a 10 m viewing distance, 6–8 mm pitch still looks good; for 3–4 m, you might prefer 3–4 mm.

Industry reports estimate the global digital signage market will exceed USD 30 billion by 2025, driven largely by brighter, more energy‑efficient LED technologies.

In real projects, we often simulate sightlines and ambient light at different times of day. A façade that looks perfect at dusk can completely wash out at noon if you underestimate direct sun or interior lighting reflections.

Energy efficiency, lifetime and maintenance profile of holographic LED displays

Compared with legacy LCD video walls or older digital signage:

- LED systems typically use 20–40% less energy for the same perceived brightness.

- The average LED display lifetime is ≥50,000 hours under standard commercial use, translating to many years of operation with proper thermal management.

- Modular design means you can replace a strip or module instead of the entire screen.

Maintenance considerations:

- Access routes: on internal catwalks, from inside the building, or via façade maintenance units.

- Cleaning: dust, fingerprints and urban pollution affect perceived contrast on glass; plan for safe, regular cleaning.

- Spare parts: agree on a minimum stock of modules and power supplies, ideally from the same batch to avoid visual mismatch later.

Practical recommendation: when you model TCO, assume at least 2–3% of modules will be replaced over a 5‑year period and include this in your budget, rather than treating failures as unexpected.

Content requirements for 3D‑style holographic visual marketing

Most disappointing holographic LED projects suffer from one root cause: conventional 16:9 content stretched onto a transparent canvas.

To unlock the “holographic” effect:

- Use strong foreground elements with motion and leave negative space so the background remains visible.

- Avoid large solid blocks of white; they kill transparency and create glare.

- Consider parallax and simple depth cues (layered objects, shadows, scale changes) rather than complex 3D renders only your team can see properly.

- Calibrate brightness schedules; at night, lower brightness looks more premium and reduces eye fatigue for passers‑by.

Teams like Zhenmei Wisdom often work with agencies and integrators to test sample content on real screens before full production; a half‑day test session can save months of rework.

Retail and Brand Advertising: Using LED Holographic Screens to Drive Sales

Storefront windows and mall atriums: attracting foot traffic and extending dwell time

For retail, LED holographic screen applications across different industries usually start at the glass: flagship storefronts, corner locations on high streets, and large mall atriums.

Instead of covering windows with posters or opaque LED walls, transparent screens let you:

- Run dynamic campaigns while still showing real merchandise behind the content.

- Keep natural light and an open feel, which many mall landlords and architects now prefer.

- Change campaigns remotely in minutes, aligning with online promotions.

Realistic outcomes we’ve seen on well‑executed deployments:

- 10–30% uplift in foot traffic for flagship stores during launch campaigns.

- Clear increase in dwell time as people stop to watch loops of 15–30 seconds.

In‑store product showcases and 3D holographic advertisement campaigns

Inside the store, smaller transparent LED or crystal film screens can wrap around display tables, shelving or freestanding cubes. You can, for example:

- Animate product features around a physical product (think rotating outlines around a sneaker or cosmetic bottle).

- Run 3D‑style promotions that visually “float” above limited‑edition products.

- Integrate interactive triggers—simple sensors, QR codes or mobile interactions—to change content based on proximity.

These are not just nice‑to‑have visual toys. When integrated with a promotion calendar, they allow retailers to run A/B tests: campaign A on a conventional lightbox vs. campaign B on a transparent LED showcase, and compare performance.

Measuring retail ROI: traffic uplift, conversion rate and basket size impact

From a CFO’s perspective, the technology is justified only if you can translate visuals into numbers:

- Foot traffic uplift: using people counters at entrances or even AI analytics from cameras.

- Conversion rate: impact on the ratio of entrants who purchase.

- Average basket size: whether highlighted products sell more or at a higher price point.

A simplified ROI model for a flagship store might look like this:

- Investment (hardware + installation + content for year 1): $120,000

- Additional gross margin per year from increased traffic and upsell: $60,000

- Simple payback: ~2 years

From my experience, retail projects that align holographic campaigns with product drops, social media and in‑store events reach payback 6‑12 months faster than “always‑on generic content” strategies.

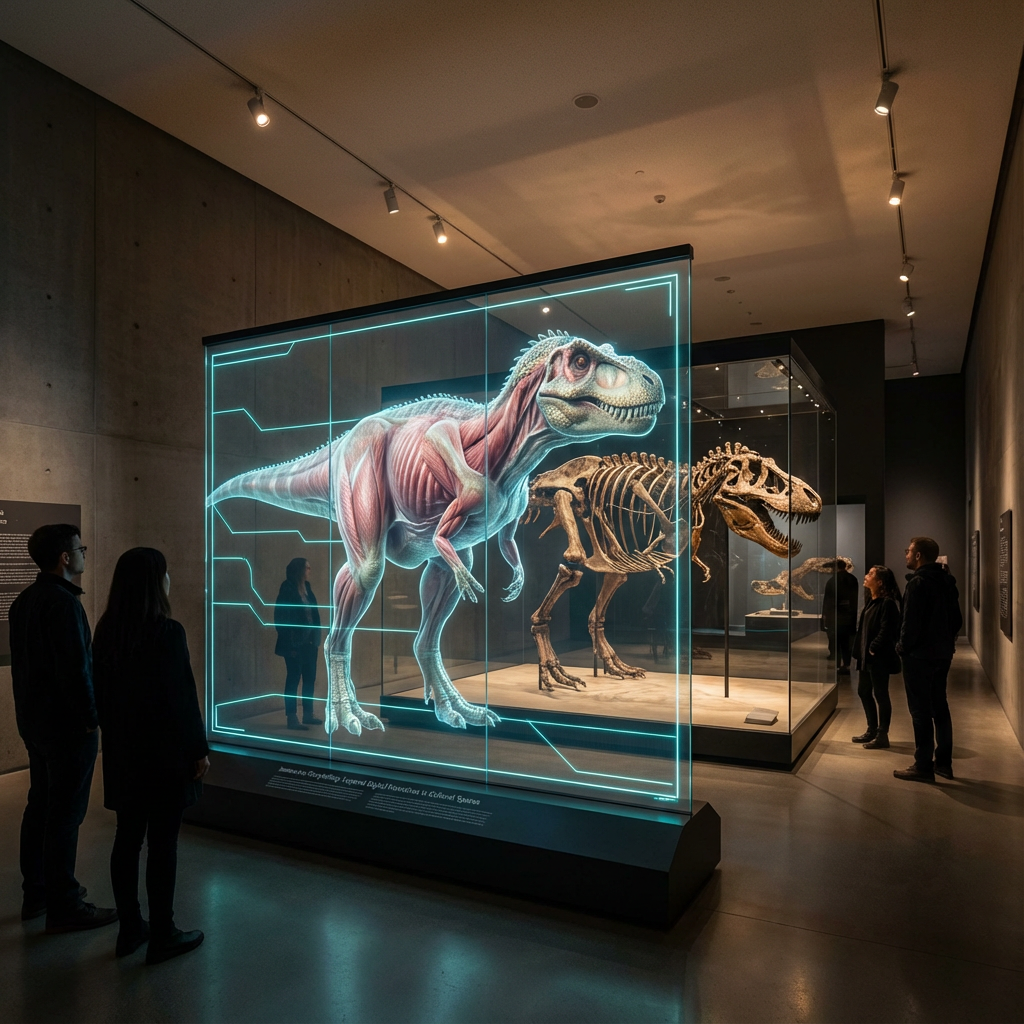

Museums, Exhibitions and Cultural Venues: Immersive Storytelling at Scale

Designing transparent LED installations for exhibitions and galleries

Curators and exhibit designers like transparent LED because it doesn’t turn galleries into black boxes. You can layer narratives onto glass partitions, balustrades or even showcase cases without hiding artifacts.

Key design principles:

- Respect circulation: content should guide visitors, not block views or exits.

- Use subtle motion and limited color palettes in sensitive spaces to avoid distraction.

- Plan for temporary vs permanent exhibits; modular transparent LED can be reused in future exhibitions.

Balancing artifact visibility with digital storytelling in museums

The common fear is that digital overlays will overshadow the physical collection. Good projects do the opposite: they help visitors understand what they’re looking at.

Examples:

- A fossil behind glass, with transparent animations showing how the animal moved.

- Historical artifacts with layered timelines that appear around them.

- Multilingual labels that can be toggled depending on the audience profile during certain times of day.

The trick is to think of the display as “augmented glass”, not as a competing screen. That typically means keeping active pixels below 30–40% of the surface at any one moment.

Visitor engagement metrics and funding justification for cultural projects

Museums and cultural venues often rely on grants, sponsorship and public funding. LED holographic screen applications across different industries are easier to fund when you can show:

- Increased dwell time in key galleries, measured by sensors or tracking studies.

- Higher participation rates in guided tours or educational programs linked to the installation.

- Sponsor visibility metrics if brands are associated with certain installations.

A museum I worked with justified a transparent LED investment by bundling it with a corporate sponsorship package: the sponsor funded more than half of the CAPEX in exchange for subtle brand integration and event rights tied to the installation.

Corporate, Hospitality and Public Spaces: Enhancing Brand Perception

Corporate lobbies, reception areas and experience centers

In corporate environments, holographic LED installations often sit in reception halls and experience centers, where they have three jobs:

- Communicate brand story to visitors and partners.

- Visualize complex data (e.g., global operations, ESG metrics).

- Provide a flexible canvas for events and VIP visits.

Transparent LED is particularly effective on glass balustrades or atrium bridges, creating content layers that feel integrated instead of added on.

Hotels, resorts and hospitality spaces: wayfinding, art and promotions

Hotels and resorts use transparent displays for:

- Animated “living art” on glass walls that change with time of day or seasons.

- Wayfinding in lobbies and corridors, without cluttering the space with freestanding signs.

- Promotions for F&B outlets, events and spa packages embedded into existing glass partitions.

Because guests are in relaxed mode, content must be carefully paced; over‑bright, fast‑moving visuals can feel more like an airport ad than a premium hospitality experience.

Airports, transit hubs and public buildings: information and sponsorship displays

In large transportation hubs, transparency is not just aesthetic—it’s a safety and operations requirement. You can’t simply block sightlines with opaque LED.

Transparent LED allows operators to:

- Show flight, train or bus information on glass while keeping visual access to gates and crowds.

- Sell premium sponsorship placements without building heavy structures.

- Integrate art programs that make infrastructure feel more human.

Here, reliability and remote monitoring become as important as visual quality. Expect stricter standards for fire behavior, EMC and structural integration.

Events, Entertainment and Experiential Marketing with LED Holographic Screens

Stage productions, concerts and live events: integrating holographic visuals

On stage, holographic LED screens serve as mid‑air canvases:

- Suspended transparent LED behind performers for deep, layered visuals.

- Side panels that reveal the band or dancers through content.

- Synchronization with lighting and pyrotechnics for coherent show design.

Because these are often high‑load touring environments, mechanical design must handle repeated rigging, vibration and quick assembly.

Trade shows and pop‑up brand activations with transparent LED solutions

At exhibitions, you’re competing with hundreds of booths. Transparent LED can:

- Turn your glass meeting rooms into dynamic storytelling spaces.

- Create “holographic product reveals” where the physical product sits behind the screen.

- Offer double‑sided content visible both inside and outside the stand.

These short‑term projects often have tight setup windows, so pre‑configured module kits and reliable connectors are crucial.

Rental versus permanent installations for event organizers and agencies

Event agencies face a different ROI equation. Owning transparent LED for rental versus relying on partners depends on:

- Utilization rate: how many days per year you can realistically rent the screens.

- Logistics: storage, transport, rigging crews and maintenance.

- Flexibility: ability to reconfigure modules into different sizes and aspect ratios.

For many agencies, partnering with a specialist rental provider or manufacturer is more realistic than owning large inventories, especially for newer technologies like flexible or curved holographic screens.

Planning and Implementing an LED Holographic Screen Project

Site assessment: glass façades, indoor vs outdoor and structural constraints

Every successful deployment starts with a site survey that looks at more than just dimensions:

- Glass type and structure: tempered, laminated, double‑glazed; load capacity and fixing options.

- Indoor vs outdoor exposure: rain, temperature swings, UV; does the screen sit behind glass or on the exterior side.

- Sun path and reflections: how sunlight or strong interior lighting will impact visibility.

- Access: for installation, future maintenance and cleaning.

Expert view: “If your integrator doesn’t ask about mullion spacing, glass composition and access routes during the first meeting, you should be cautious about handing them a six‑figure façade project.”

Integration with control systems, content management and existing signage

From a systems integration perspective:

- Decide early whether holographic LED is part of your broader digital signage network or a standalone feature.

- Ensure the chosen hardware works with your current CMS, scheduling tools and analytics platforms.

- Consider redundancy: dual controllers, backup media players, and failover paths for mission‑critical areas like airports or large malls.

Specialized suppliers such as Zhenmei Wisdom typically support integration with standard control protocols and can collaborate with your IT and facility teams on network and security requirements.

Typical project timeline from design to commissioning

Timelines vary by scale, but a realistic roadmap for a medium‑size façade might be:

- 2–4 weeks: site survey, concept design, budgetary estimate.

- 4–6 weeks: detailed engineering, structural checks, content planning.

- 6–10 weeks: manufacturing, FAT (factory acceptance testing) and logistics.

- 2–4 weeks: on‑site installation, commissioning and staff training.

Total: roughly 4–6 months from first workshop to go‑live for a well‑managed project.

Cost Structure, ROI Models and Total Cost of Ownership

Breaking down costs: hardware, installation, content production and operations

For B2B buyers, the headline “price per square meter” is only one part of the equation. A typical cost stack includes:

- Hardware: transparent LED modules/film, frames, controllers, power supplies.

- Engineering and installation: brackets, cabling, structural work, lifts or scaffolding.

- Content: initial campaign development, templates, testing and optimization.

- Operations: power consumption, CMS licenses, monitoring, periodic cleaning and maintenance.

Hidden costs often show up in access equipment (e.g., special lifts) and building permissions. Clarify responsibility for these early in the contract.

ROI calculation examples for retail, museums and corporate buyers

Different industries measure value differently:

- Retail: incremental sales, higher rent premiums for flagship locations, media value if you treat the façade as an owned advertising channel.

- Museums: increased visitor numbers, sponsorship revenue, educational impact used in grant applications.

- Corporate: brand perception, visitor experience, support for key events (AGMs, product launches), sometimes backed by HR or ESG budgets.

You can build a simple ROI model by estimating incremental yearly benefits and dividing CAPEX plus a few years of OPEX. For flagship retail, a 2–3 year payback is common; museums and corporate projects may justify longer horizons because they also serve non‑financial objectives.

Long‑term considerations: energy costs, maintenance and upgrades

When comparing suppliers, ask for:

- Typical power consumption per m² at your intended brightness settings, not just “maximum”.

- Warranty length and what it covers (modules, power, control, labor).

- Availability of future module replacements and compatibility with later upgrades.

If you plan to upgrade sections over time, choosing a manufacturer with stable product families and backward compatibility will avoid future patchwork façades.

Common Misconceptions, Risks and How to Avoid Project Failure

Misunderstandings about transparency, brightness and 3D effects

Three recurring misconceptions:

- “The screen will be invisible when off.” In reality, you will still see the structure or film at certain angles.

- “Any content will look holographic.” Without careful design, content can look flat or messy.

- “Higher brightness is always better.” Excessive brightness creates glare and can attract complaints from neighbors or authorities.

Educating internal stakeholders early prevents unrealistic expectations.

Technical and operational risks: reflections, glare, heat and access

On glass, reflections are often your biggest enemy. You can mitigate them by:

- Managing interior lighting near the glass.

- Using darker or more saturated content in highly reflective conditions.

- Adding shading elements or anti‑reflective treatments in extreme cases.

Thermal management is another risk. Enclosed cavities behind glass can trap heat, shortening LED lifetime. Proper ventilation and thermal modeling are not optional.

Compliance, safety and data integration pitfalls in commercial environments

Don’t overlook:

- Fire safety: certification of materials, cabling and power distribution according to local standards.

- Structural approvals: working with façade engineers to confirm loads and fixings.

- Data and IT policies: ensuring content systems comply with corporate cybersecurity rules.

These are areas where experienced partners and clear documentation make a real difference.

Industry Case Studies: Measurable Outcomes from Real Deployments

Retail brand case: storefront holographic campaign and sales impact

A fashion brand installed a high‑brightness transparent LED façade on a 12‑meter‑wide storefront in a major city. Over a 90‑day launch period:

- Foot traffic increased by about 22% compared with the same period last year.

- Conversion rate improved by 7%, largely driven by a limited‑edition product highlighted on the screen.

- Social media mentions of the store location spiked due to user‑generated videos of the “floating” visuals.

The project paid back its incremental cost within roughly 18 months.

Museum or cultural center case: visitor engagement and funding results

A regional museum used transparent LED on glass partitions to visualize historical city changes. Sensors measured dwell times in the area:

- Average dwell time near the installation doubled compared with the previous static panels.

- The museum used these numbers to secure additional funding for a second phase and attracted a local corporate sponsor.

Corporate or hospitality case: brand perception and guest satisfaction

A global company’s headquarters integrated transparent LED into its lobby glass wall, showing real‑time data on sustainability initiatives and project highlights. Post‑visit surveys found:

- 80% of visitors rated the lobby experience “memorable” or “very memorable”.

- Internal stakeholders started using the space more frequently for partner events, increasing the utilization of the investment.

In hotels, similar installations have correlated with higher guest satisfaction scores for “ambience” and “design” segments of surveys.

How to Choose the Right LED Holographic Screen Supplier

Key technical questions to ask LED display manufacturers

When you engage potential suppliers, ask concrete questions:

- What transparency and pixel pitch options do you offer for my viewing distances?

- What is the typical and maximum brightness, and at what power consumption?

- How are modules serviced—front, rear, or from the side?

- Can you provide photometric data and sample content tests for my site conditions?

Actionable tip: request a small pilot setup on site or in a similar environment before finalizing specs; seeing real content in your light conditions is more valuable than any PDF.

Evaluating product quality, certifications and after‑sales service

Beyond demo videos, check:

- Certifications: safety, EMC, environmental standards relevant to your region.

- References: similar projects in your industry or with comparable environmental conditions.

- Service structure: local partners, spare parts logistics, response times, remote monitoring options.

Manufacturers like Zhenmei Wisdom that integrate R&D, production and sales can often adapt products to specific architectural requirements and support long‑term roadmaps rather than one‑off deliveries.

Custom projects and collaboration with architects, designers and integrators

The most successful holographic LED deployments happen when:

- Architects, lighting designers, content creators and the LED manufacturer collaborate early.

- Design decisions account for structural, electrical and content needs simultaneously.

- Mock‑ups are used to align aesthetics and practicality.

If you plan a complex façade or creative installation, consider reviewing technical resources from specialized suppliers or reference cases from platforms such as the Zhenmei Wisdom project gallery (transparent LED showcases and other references available at https://en.zmleds.com/l).

Future Trends in Holographic LED and Transparent Display Technology

Emerging innovations: finer pixel pitch, higher transparency and interactivity

Technically, three main trends are in motion:

- Finer pixel pitches at similar transparency levels, improving medium‑distance viewing.

- Even lighter and more flexible substrates, enabling complex curves and 3D structures.

- Integration of touch or gesture recognition for interactive glass walls in retail and museums.

As manufacturing improves, the trade‑off between resolution and transparency will gradually soften.

Integration with sensors, AI analytics and immersive experience platforms

LED holographic screens are becoming nodes in larger experience ecosystems:

- Sensors count people, track dwell time and adapt content in real time.

- AI‑based analytics optimize messaging across a network of screens based on performance.

- Integration with AR and mobile experiences creates cross‑channel storytelling where the glass becomes one layer among many.

This moves projects from “nice screen” to “measurable media asset” territory.

How holographic LED technology fits into the wider digital signage roadmap

For most organizations, holographic LED will be a premium layer, not a replacement for all signage. A typical roadmap:

- Use transparent LED on high‑impact flagship locations (facades, lobbies, key galleries).

- Maintain conventional LED or LCD for information‑heavy, close‑view applications.

- Connect all displays into a unified CMS and analytics stack for coherent management.

Thinking about roles—impact vs information—helps avoid overusing technology where it doesn’t belong.

FAQs on LED Holographic Screens for Business Buyers

Which industries gain the fastest payback from holographic LED displays?

Retail (especially fashion, electronics and automotive showrooms), airports, large malls and high‑traffic cultural venues typically see the fastest payback, because incremental attention converts directly into sales, rent premiums or sponsorship value.

Do LED holographic screens work outdoors and in direct sunlight?

They can, provided you choose high‑brightness models, design content with contrast in mind and account for sun angles. However, south‑facing glass in very bright climates can still challenge even powerful LEDs, so site‑specific studies are essential.

What level of content expertise and ongoing support do you need?

You don’t need an in‑house 3D studio, but you do need either an agency or internal creatives who understand transparent canvases and motion design. On the technical side, plan for at least basic CMS operators and a maintenance arrangement with your integrator or manufacturer.

Conclusion and Practical Checklist for Your Next Project

After a decade of seeing LED holographic screen applications across different industries, one pattern stands out: projects succeed not because the hardware is impressive, but because the team aligns technology, content and business goals from day one. When the façade becomes both an architectural feature and a measurable media channel, procurement, marketing and operations all see value.

Before you move forward, align internally on what you want the installation to achieve: more traffic, better storytelling, or a stronger brand impression for visitors and partners. From there, build a realistic budget, involve the right stakeholders and select partners who can support you from design to long‑term operations.

A simple checklist for planning a successful deployment:

1) Clarify objectives and key metrics (traffic, sales, engagement, sponsorship).

2) Conduct a thorough site survey, including sun paths and structural review.

3) Define viewing distances, transparency needs and brightness requirements.

4) Shortlist suppliers with relevant certifications and references.

5) Run a pilot or mock‑up with real content in similar conditions.

6) Finalize content strategy, scheduling and CMS integration.

7) Plan for maintenance, cleaning and periodic content refreshes.

8) Review results against your ROI assumptions and refine for future rollouts.

For many organizations, starting with one flagship location or exhibition space is the smartest approach. A well‑documented pilot becomes your internal “case study”, making it much easier to scale across additional stores, venues or buildings with confidence.

References and Further Reading

- “Global Digital Signage Market Forecast 2025”, various industry research reports.

- Technical documentation and application notes from leading transparent LED and holographic display manufacturers.

- Design guides for digital media façades and transparent display integration published by architectural and lighting associations.