A practical 2025 guide to LED display industry trends for B2B buyers, covering market growth, technology shifts, ROI, risk, and concrete selection frameworks for commercial projects.

Finding the right LED display solution today feels a bit like trying to refit an aircraft while it’s in the air: marketing is pushing for “wow”, finance wants hard ROI, and engineering is trying to keep power, heat, and maintenance under control. I’ve sat in too many project rooms where teams argue about Mini LED vs MicroLED or transparent vs “normal” LED, while the real issues are viewing distance, content, and who will maintain the wall three years from now. With the LED display industry heading toward nearly USD 20 billion in 2025 and tightening energy and building regulations, mistakes are getting expensive. So the real questions are simple: which market trends actually matter for your next deployment, what specs change your total cost of ownership, and how do you de‑risk supplier and technology choices without slowing projects down?

What B2B Buyers Need to Know About LED Display Market Trends in 2025

- The LED display industry is set to reach roughly USD 19–20 billion in 2025 and around USD 26 billion by 2030, driven by DOOH, retail, corporate, sports, and XR.

- LED displays beat LCD walls when you need high brightness, seamless large canvases, wide viewing angles, and flexible shapes or transparency.

- Trends that truly affect procurement today: fine‑pitch down to ~1 mm, COB/GOB packaging, higher refresh rates, energy efficiency, and transparent/flexible formats for glass and creative spaces.

- Mini/MicroLED are important for premium fine‑pitch and longevity, but pricing and supply constraints still keep them in higher‑end or flagship projects.

- Transparent LED film and holographic displays are powerful for retail and architecture, but only when brightness, transparency, and content design are engineered together.

- TCO is now dominated by power, structure, control systems, and maintenance, not just panel price per square meter.

- A robust LED project plan always includes pixel pitch rules, brightness targets by environment, acceptance tests, and a clear spare‑parts strategy.

- Supplier choice should be based on QA, certifications, warranty clarity, and real project references—not just catalog specs and a low headline price.

From Market Growth to Real-World Demand: How the LED Display Industry Is Evolving

The headline story is straightforward: the LED display industry keeps growing faster than the broader display market. TrendForce data cited by multiple sources puts the LED display market around USD 8.96 billion in 2023; Mordor Intelligence expects about USD 19.67 billion by 2025 and roughly USD 25.98 billion by 2030. Different analysts use slightly different definitions, but the curve is consistently upward.

Industry data indicates that while the global display market is about USD 140+ billion, direct‑view LED (DVLED) is taking an increasing share of large‑format, high‑brightness installations.

Behind those numbers, the demand story is quite segmented:

- DOOH and large advertising: LED has already replaced much of the printed and LCD billboard world. Here, pitch can be relatively coarse (e.g., 4–10 mm), but brightness, uptime, and service access dominate.

- Sports and stadiums: large perimeter boards and scoreboards demand robust cabinets, ingress protection, and excellent viewing angles; more clubs now invest in fine‑pitch indoor LED for premium areas.

- Retail and corporate: fine‑pitch LED video walls in lobbies, flagship stores, and experiential zones are moving from “nice‑to‑have” to “identity infrastructure.”

- Transportation and control: airports, rail hubs, and control rooms need long‑life, high‑legibility displays that can run 18–24 hours a day with minimal color drift.

- XR and virtual production: still smaller in volume, but very high in value per square meter and highly demanding technically.

On top of this, three macro forces are reshaping how procurement and engineering teams treat LED investments:

1) Energy prices and sustainability

Rising electricity costs and ESG targets mean power consumption (W/m² at nominal brightness) has become a board‑level topic. Many buyers now ask for power at realistic brightness (e.g., 500–800 nits indoors, 3,000–4,000 nits outdoors) instead of just “maximum” specs.

2) Regulation and building integration

Fire codes, glass safety, EMC requirements, and local advertising rules all influence whether a screen is even allowed, especially on facades and in transportation hubs. Building engineers worry about load, heat, and access in a way marketing teams sometimes underestimate.

3) Supply chain and localization

Geopolitics, logistics cost, and lead‑time risk are making buyers look more closely at where modules and driver ICs come from, and whether spare capacity is secured for large, multi‑site rollouts.

In day‑to‑day projects, this means LED display market trends matter less as abstract CAGR and more as a set of constraints: can you get stable supply of a given pixel pitch, is the control ecosystem mature, and can operations keep the wall calibrated over five to seven years?

Core Technology Shifts: From Fine-Pitch DVLED to Mini/MicroLED and All-In-One Systems

Direct-view LED vs LCD video walls: brightness, seams, lifespan and integration differences

Direct‑view LED (DVLED) emits light directly from LEDs on a module, whereas an LCD video wall is a set of backlit LCD panels tiled together. In practice:

- Brightness: DVLED comfortably reaches 800–1,500 nits indoors and 4,000+ nits outdoors; LCD video walls struggle in full sun or atrium glare.

- Seams: DVLED cabinets can be visually seamless; LCD walls always have bezels, even “ultra‑narrow” ones.

- Lifespan behavior: both may quote 50,000–100,000 hours, but LED luminance decay and color drift are easier to manage with recalibration and module swaps; LCD often ages more uniformly until backlights or panels fail.

- Integration: LED offers more freedom in aspect ratio, curvature, and size, but requires deeper upfront work on structure, cabling, and power.

For buyers, DVLED beats LCD where impact, flexibility, and brightness matter more than initial cost—think flagship lobby, LED stage, massive DOOH canvas, or transparent facade.

Expert view: for projects above roughly 5–7 m wide, DVLED usually becomes the more rational long‑term choice once you include structural and content flexibility in the analysis.

Fine-pitch, Mini LED and MicroLED: what changes for image quality, cost and use cases

Fine‑pitch generally refers to pixel pitch below ~2 mm. Mini LED often means smaller LED packages enabling denser pitches and better uniformity; MicroLED goes further with micrometer‑scale emitters.

- Image quality: finer pitch allows closer viewing and more realistic content, but camera‑based use (XR, broadcast) also depends on refresh rate, scan mode, and driver IC quality.

- Cost: every step down in pitch increases LED count per square meter and assembly complexity; Mini/MicroLED is still priced at a premium, with MicroLED largely reserved for top‑end, short‑distance applications.

- Use cases: fine‑pitch SMD/COB covers most corporate, retail, and control rooms today; Mini/MicroLED shows up in premium boardrooms, broadcast sets, and luxury retail.

Data point: some reports put the Mini/MicroLED market around USD 1.5 billion in 2023, indicating strong momentum but not yet mass commoditization.

A practical rule: if your minimum viewing distance is above 3–4 m, you probably don’t need MicroLED; a well‑engineered fine‑pitch SMD or COB display is more cost‑effective.

All-in-one LED display systems for meeting rooms and lobbies: benefits, limits and when to avoid them

All‑in‑one (AIO) LED systems integrate LED modules, structure, controller, audio, and often OS into a single package.

Benefits:

- Faster deployment and fewer interfaces; IT can treat it almost like a giant monitor.

- Clean industrial design with predefined sizes (e.g., 120–180").

- Simplified maintenance plans from a single vendor.

Limits:

- Less flexibility in aspect ratio, size, and pixel pitch.

- Tight control ecosystem; swapping components or integrating with complex control rooms can be harder.

- Scaling beyond one or two units in a space may require modular walls anyway.

Use AIO when you want predictable, repeatable meeting and presentation rooms; avoid it when you need architectural integration, curved forms, transparency, or unusual aspect ratios.

Engineering the Screen: Pixel Pitch, Brightness and Packaging Choices That Decide Success

Pixel pitch and viewing distance: practical rules for specifying indoor and outdoor LED video walls

Pixel pitch selection is one of the most common and most misunderstood decisions. A simple starting framework:

- Indoor corporate/retail, minimum viewing distance 2–4 m: 1.2–1.9 mm.

- Control rooms with detailed data, 1.5–3 m viewing: 0.9–1.5 mm, depending on budget.

- Indoor stage or auditorium, 5–15 m viewing: 1.9–3.9 mm.

- Outdoor DOOH at 20–60 m: 4–10 mm, chosen by content detail and structure height.

Executable tip: start from the minimum viewing distance, multiply it by 0.3–0.5 to get a rough pitch in millimeters (e.g., 5 m viewing → ~1.5–2.5 mm).

For XR and broadcast, pixel pitch interacts with camera sensor, distance, and lens; moiré and scan artifacts matter as much as nominal pitch.

Brightness, refresh rate and color depth: how to match LED performance to ambient light and content

Brightness targets must match environment and content:

- Indoor standard spaces: 400–800 nits is usually enough; running at 30–50% of maximum extends lifespan.

- Indoor high‑ambient (atriums with glass): 800–1–500 nits effective.

- Outdoor daytime: 3,000–6,000 nits, depending on sun exposure and orientation.

Refresh rate:

- For human viewers only, 1,920 Hz and above is typically comfortable.

- For cameras (XR, broadcast), 3,840 Hz or higher with appropriate scan and driver IC becomes essential to avoid flicker and scan lines.

Color depth and calibration:

- Bit depth (13–16 bit) and good grayscale handling are needed for low‑brightness scenes and gradients.

- Factory calibration is not enough; plan for periodic on‑site recalibration to maintain uniformity.

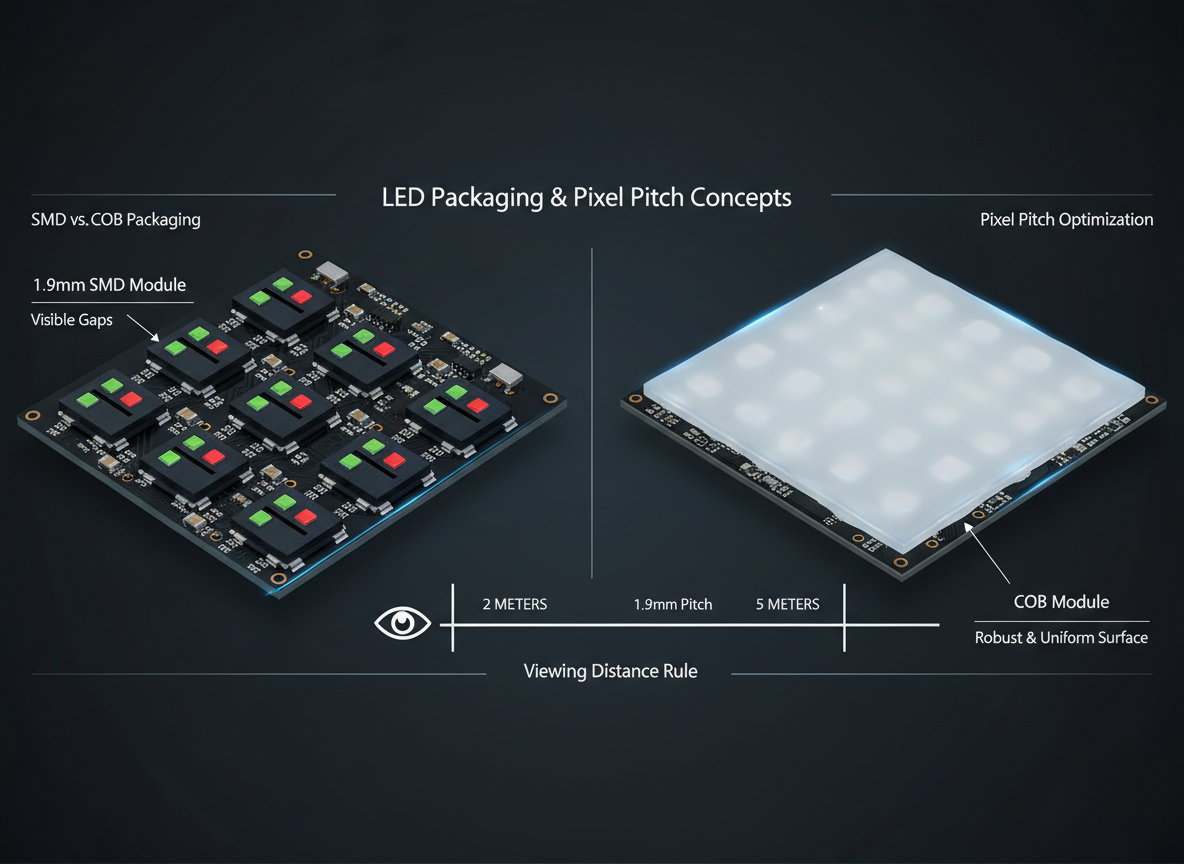

COB vs SMD vs GOB packaging: reliability, serviceability and protection trade-offs for B2B projects

SMD (Surface‑Mounted Device):

- Traditional approach with individual LED packages on the PCB.

- Easier to repair single LEDs or small clusters.

- More vulnerable to impact and moisture, especially at fine pitch.

COB (Chip‑on‑Board):

- LED chips mounted directly on a substrate, often with a protective layer.

- Better robustness and often better thermal behavior.

- Repair is more module‑level than pixel‑level; requires more specialized service.

GOB (Glue‑on‑Board):

- Essentially SMD with a transparent protective resin over the LEDs.

- Excellent protection against physical damage, dust, and moisture; good for public and rental environments.

- Can affect surface reflection and slightly alter viewing characteristics if poorly executed.

Expert view: in high‑traffic indoor environments or transparent/holographic installations where the surface is exposed, GOB or COB makes more sense than naked SMD, even if the initial price is higher.

For a buyer, the right choice depends on: expected touch or impact, cleaning method, uptime requirements, and local service capability.

Transparent, Holographic and Flexible LED Displays: Trend Hype vs Deployable Solutions

Transparent LED displays and film screens on glass: brightness, transparency and content constraints

Transparent LED displays and LED film screens have become a defining image of the modern retail facade: content floating on glass without blocking the view. But there are hard physics constraints:

- Higher transparency usually means lower LED density, which reduces brightness and perceived resolution.

- On bright streets, a “high transparency, low brightness” product can become invisible at midday.

- Content with thin text, dark backgrounds, or subtle gradients fails; bold shapes and high contrast win.

Practical rule: treat transparency as a variable, not a goal—aim for the lowest transparency that still meets architectural needs while preserving brightness and image clarity.

Film‑type products, such as transparent LED film screens from specialist manufacturers like Zhenmei Wisdom, offer lightweight, glass‑friendly installation, but require very careful routing of power/data and planning for thermal expansion.

Holographic LED screens vs crystal film screens: visual effect, structure and ideal applications

“Holographic” LED screens, as used in commercial spaces, usually refer to high‑transparency LED structures that create a floating 3D‑like effect rather than true holography. Crystal film screens, by contrast, are thin, often adhesive LED films applied to glass.

Holographic screens:

Strong suspended visual effect and depth cues.

Often used in atriums, malls, and exhibition spaces.

Structure is more three‑dimensional; more visible from some angles.

Crystal film / LED film screens:

Very thin and light; bonded or fixed to glass surfaces.

Better when facade integrity and minimal structural change are important.

Cabling, edge finishing, and long‑term adhesion are key engineering concerns.

In retail, a crystal film on shop windows can deliver subtle, integrated messaging, while a holographic screen in an atrium can create a “hero” installation. Both need appropriate brightness and content design.

Flexible and creative LED displays: structural, safety and maintenance considerations for architects

Flexible and creative LED solutions—curved columns, wave‑shaped ceilings, ribbons—look spectacular, but involve real constraints:

- Minimum radius: every flexible module has a minimum bending radius. Exceeding it risks micro‑cracks or LED failure over time.

- Structure: the support structure must be designed for both static and dynamic loads; some creative forms add torsion and vibration.

- Maintenance: access to the back of curved or suspended surfaces is often forgotten in design; if a module fails, how will technicians reach and remove it safely?

Executable advice: involve structural engineers and maintenance teams at concept stage; ask manufacturers for detailed 3D fixing and service drawings before sign‑off.

Specialist vendors focused on transparent, holographic, and creative LED—such as those offering holographic screens, crystal film, and custom shapes—are often better equipped to handle these complexities than generic catalog suppliers.

Application Hotspots: Where LED Display Investment Creates the Most Value

DOOH advertising and sports venues: revenue models, uptime expectations and spec priorities

In DOOH and stadiums, LED is not a “screen project”; it is a revenue engine.

- Revenue: sold by impressions, footfall, or sponsorship; any downtime directly eats income.

- Uptime: SLAs often require 99%+ uptime, particularly during events and peak hours.

- Spec priorities: high brightness, contrast, robust IP rating, good calibration stability, and easy front or rear service.

A common trap is optimizing for low CapEx by accepting lower‑grade power supplies or minimal redundancy. Over a 5–7 year contract, that decision can flip the economics.

Retail flagships, malls and corporate lobbies: experience design, transparency and branding impact

In retail and corporate environments, LED supports brand experience and tenant value:

- Flagships: fine‑pitch video walls, LED ceilings, or transparent facades are used to drive dwell time and social sharing.

- Malls: central atrium LED sculptures or holographic screens help landlords differentiate and attract premium tenants.

- Corporate lobbies: a large LED wall serves as both a branding tool and an internal communication channel.

Here, integration with architecture and lighting is more important than extreme brightness. Transparent LED film on glass, for instance, must be balanced with daylight and privacy requirements.

Control rooms, transportation hubs and XR virtual production: camera use, redundancy and latency needs

Control rooms and transportation hubs prioritize legibility, reliability, and data density:

- Control rooms: require low‑glare surfaces, consistent color across large canvases, and ergonomic viewing distances for operators.

- Transportation: signage must remain readable under diverse lighting and viewing angles; failover must be predictable.

XR and virtual production add further layers:

- LED must be camera‑safe: high refresh, appropriate scan, and careful calibration to avoid moiré and color shift across the wall.

- Latency from content engine to wall must be low and deterministic for in‑camera VFX to work.

- Thermal stability becomes crucial under high brightness and continuous operation.

These applications underline why “trend” specs (e.g., MicroLED) are less important than engineering fundamentals and control ecosystem maturity.

Pricing and Supply Chain Signals: Components, Controllers and Service Models Behind the Screen

How LEDs, driver ICs, chiplets and cabinets influence price per square meter and lead times

Panel price per square meter is a function of a few core levers:

- LED package type and pitch: more LEDs and more advanced packaging (COB, MicroLED) raise cost.

- Driver IC and backplane: higher refresh and grayscale performance, and emerging chiplet backplanes, add cost but improve camera performance and stability.

- Cabinet design: lightweight, high‑precision cabinets with good thermal paths cost more but simplify installation and reduce long‑term mechanical issues.

Lead time is influenced by how standardized the product is, how deep the vendor’s stock of LED batches is, and supply conditions for driver ICs and power supplies.

LED display controllers, sending/receiving cards and software ecosystems B2B buyers should understand

Too many LED projects treat the controller as a minor detail. In reality:

- Sending/receiving cards define maximum resolution, refresh rate, and failover behavior.

- Control software affects how easy it is to schedule, monitor, and troubleshoot content.

- Integration with existing AV/IT systems, content management, and monitoring platforms often dictates operational success.

Executable tip: insist on a brief technical architecture document from suppliers showing controller model, redundancy plan, network topology, and integration points with your existing systems.

Ownership options: CapEx purchase, rental and managed service models for commercial LED deployments

Depending on project type:

- CapEx: classic purchase, suits long‑term, permanent installations; requires internal capacity or a maintenance contract.

- Rental: ideal for events or short‑term activations; cost per day is higher but avoids ownership risk.

- Managed service: provider owns the asset and delivers “screen as a service,” often including content management and uptime SLAs.

As operating cost rises, more buyers explore managed models, especially for complex DOOH networks or high‑profile retail facades.

Building the Business Case: ROI and Total Cost of Ownership for LED Display Projects

Beyond hardware price: power consumption, structure, cooling and control system cost drivers

On a multi‑year horizon, hardware is often less than half of total cost. The other big buckets:

- Power: kW per m² × operating hours × electricity price drives recurring cost.

- Structure: steel or aluminum frames, glass reinforcement, anchors, and access provisions.

- Cooling: HVAC upgrades or localized extraction where heat load is significant.

- Control and content: media servers, controllers, networking, and content creation.

Executable suggestion: for every LED proposal, ask the integrator to quote estimated annual power at realistic brightness, not just “maximum” specs.

Simple TCO and ROI calculation frameworks for LED video walls and transparent LED installations

A practical TCO model for a 5‑year period:

TCO = CapEx (screen + structure + controllers)

+ (power cost per year × 5)

+ (maintenance hours × labor rate × 5)

+ spare parts (initial + expected replacements)

For ROI, compare uplift:

- DOOH: incremental ad revenue vs existing static or LCD inventory.

- Retail: sales uplift or dwell‑time increase in zones with LED vs control zones.

- Corporate: reduced printing, improved communication efficiency, and brand value (harder to quantify but still real).

Even a rough model is better than none; it often reveals that low‑efficiency panels or weak maintenance support are more expensive in the long run.

How energy efficiency, maintenance labor and downtime risk change the “cheapest supplier” ranking

A vendor with 10–15% higher panel efficiency, a better warranty, and a solid local service team may cost more upfront but reduce both energy and downtime cost significantly.

Expert view: in high‑value locations (airports, flagships, stadiums), an extra percentage point of uptime can easily outperform a 5–10% discount on hardware.

This is where operational teams should have a strong voice in supplier evaluation, not just procurement and marketing.

A B2B Selection Framework: Step-by-Step Process for Choosing the Right LED Display Solution

From use case to specification: environment, content type, viewing distance and camera requirements

Start with use case, not with pitch:

1) Define environment: indoor / outdoor, ambient light, dust, moisture, temperature range.

2) Define content: text vs video, data density, use with cameras or not.

3) Define users: typical and minimum viewing distances, critical angles, expected dwell time.

4) Define lifecycle: operating hours per day, target lifespan, allowed downtime.

For XR or broadcast, add camera details: sensor type, frame rate, and typical working distances.

Translating requirements into specs: pixel pitch, brightness, protection level, packaging and controller

Once requirements are clear:

- Pixel pitch: use viewing distance rule to set a target pitch.

- Brightness: set target in nits by environment; avoid overspec, which wastes power and accelerates aging.

- Protection/IP: outdoor or exposed indoor areas may need IP54+ or impact‑resistant surfaces.

- Packaging: choose between SMD, COB, and GOB based on traffic, risk of impact, and cleaning.

- Controller: select a control ecosystem that supports required resolution, refresh, redundancy, and integration.

Executable checklist: for each project, maintain a one‑page “spec translation” sheet linking use case → technical specs; use it to compare suppliers on like‑for‑like terms.

Decision tree for standard, transparent, holographic and flexible LED displays in commercial projects

A simple way to short‑list form factors:

- Need a solid, high‑impact canvas and no transparency? → Standard DVLED cabinets or fine‑pitch video wall.

- Need to keep visibility through glass and add content overlay? → Transparent LED film or mesh; carefully balance transparency vs brightness.

- Need strong 3D‑like presence in open air or atriums? → Holographic LED structures.

- Need curved or creative shapes as part of architecture? → Flexible/creative LED with structural design support.

In many building projects, a combination works best: for example, fine‑pitch LED in the lobby plus transparent LED film on street‑facing glass, supplied and engineered by a specialist in transparent/holographic solutions. Evaluating such specialists via their solution hubs (e.g., a product and application overview page) helps align expectations early in the design phase.

Deployment and Operations: Installation, Testing, Calibration and Monitoring Best Practices

Pre-installation planning: structural load, access, safety and integration with building systems

Good LED projects are won or lost before the first cabinet arrives:

- Structural: confirm load paths, anchor points, and deflection under weight and wind (for facades).

- Access: plan maintenance routes, lift or scaffolding access, and safe working platforms.

- Safety: meet fire, electrical, and glass safety codes; consider emergency shutdown and signage.

- Integration: coordinate with HVAC, sprinklers, lighting, and IT networks.

Factory and site acceptance testing: dead-pixel policy, color uniformity and documentation to require

At factory and on‑site, you need clear acceptance criteria:

- Dead‑pixel policy: maximum allowed per module/area and distribution rules.

- Color and brightness uniformity: test at several brightness levels with solid patterns and gradients.

- Functional tests: redundancy, failover, and control software operations.

Executable advice: include a written FAT/SAT checklist in the contract, with sign‑off criteria for defects, uniformity, and documentation (as‑built drawings, wiring diagrams, calibration reports).

Ongoing operations: calibration schedule, module replacement, monitoring and spare-parts strategy

After handover:

- Calibration: schedule recalibration at least annually for high‑visibility indoor walls; more often outdoors in harsh environments.

- Module replacement: keep a defined percentage of spare modules, cabinets, and critical components from the same batch.

- Monitoring: use control software or NMS to track temperature, faults, and brightness over time.

A disciplined spare strategy, especially for specialized products like transparent film or creative shapes, prevents visual mismatches when later batches don’t perfectly match the original.

Common Mistakes and Risks in LED Display Projects (and How to Avoid Them)

Underspecifying brightness, over-optimizing transparency and other design-stage pitfalls

Typical design mistakes include:

- Choosing a transparent product with very high transparency but inadequate brightness for a sun‑facing window.

- Underspecifying brightness for indoor atriums flooded with daylight, leading to washed‑out images.

- Over‑aggressive pitch reduction in search of detail, blowing up budget with minimal perceived benefit.

The cure is to test with real‑world light measurements and sample modules on site whenever possible.

Ignoring content workflow, control room staffing and software training in project planning

An LED wall without a content and operations plan is an expensive black rectangle:

- Who creates, updates, and approves content?

- Who monitors and responds to alarms out of hours?

- Who is trained on control software, especially for XR or multi‑zone DOOH networks?

Executable suggestion: treat “content and operations” as a separate workstream with its own budget and milestones from day one.

Contract and warranty risks: vague SLAs, incomplete spare strategies and missing acceptance criteria

Without clear contracts:

- Dead‑pixel disputes become painful and subjective.

- Response times can be longer than your operational tolerance.

- You may discover that brightness decay is not covered under “warranty” at all.

Clear, written clauses and a documented spare strategy protect both sides and reduce friction.

Evaluating LED Display Suppliers: Proof of Capability, Certifications and Warranty Terms

Supplier due diligence: factory QA, binning strategy, certifications and reference projects

Beyond brochures, check:

- Factory QA: burn‑in procedures, inspection processes, and traceability.

- Binning: how LEDs are grouped for color and brightness consistency across modules and batches.

- Certifications: safety (e.g., CE, UL where relevant), EMC, and environmental standards.

- References: similar‑scale projects in comparable environments, not just photos.

Specialist manufacturers in areas like transparent and holographic LED solutions often publish detailed case studies and technical notes—these are valuable EEAT signals.

Key contract clauses: warranty scope, dead-pixel and brightness decay policies, response SLAs

In contracts, push for clarity on:

- Warranty duration and what is actually covered (modules, power supplies, controllers).

- Brightness: is there a guaranteed percentage of initial brightness at a given year?

- Dead‑pixel policy: per module, per cabinet, and per overall area.

- Response SLAs: remote support time, on‑site intervention time, and spare availability.

Executable tip: ask suppliers to attach their standard dead‑pixel and brightness policies as annexes, not just mention “industry standard” in text.

When to choose specialist vendors for transparent and holographic LED solutions in retail and architecture

Transparent LED film, holographic structures, and creative shapes sit at the intersection of architecture, structural engineering, and media. For these, a vendor that focuses on transparent and holographic displays, with strong experience on glass and creative installations, is often a safer choice than a generalist.

A good example is a manufacturer that offers LED holographic screens, crystal film screens, and flexible transparent solutions, with documentation tailored to retail windows, malls, and corporate lobbies—and an internal engineering team that can support structural and maintenance planning. Evaluating such specialists via their solution hubs (e.g., a product and application overview page) helps align expectations early in the design phase.

Practical Questions B2B Teams Ask About LED Display Industry Trends

How long do commercial LED displays really last under continuous use?

Under realistic brightness and good thermal design, many installations run 7–10 years, but “usable life” depends on how much brightness and color shift your brand tolerates. Running at 30–50% of maximum brightness and ensuring good ventilation extends life significantly.

What are typical failure modes and maintenance workloads for indoor and outdoor LED walls?

Common failures include dead pixels, failing power supplies, and data chain issues. Indoor walls see more issues from handling and cleaning; outdoor walls add moisture, UV, and temperature cycling. Expect periodic inspections, cleaning, and occasional module or power supply replacement.

When does it make sense to upgrade from LCD to a fine-pitch LED video wall?

If you need a larger, bezel‑free canvas, higher brightness, or non‑standard aspect ratios—and have a multi‑year horizon—fine‑pitch LED is often preferable. The tipping point usually comes when you redo a lobby, control room, or flagship store and want the display to act as core architecture rather than an add‑on.

Conclusion and Next Steps for LED Display Projects in 2025 and Beyond

The LED display industry in 2025 is not just about bigger, brighter canvases; it is about smarter engineering, clearer contracts, and a more honest view of total cost and risk. Market trends—from fine‑pitch DVLED and Mini/MicroLED to transparent film and holographic structures—only matter if they map cleanly onto your environments, content, and operational capacity. For most B2B buyers, the winning strategy is simple: start with use cases and viewing conditions, translate them into disciplined specs, and then pressure‑test suppliers on QA, service, and TCO—not just on pixel pitch and price.

Next steps you can take this quarter: pick one upcoming project, build a one‑page spec‑translation sheet, request like‑for‑like quotes from at least two vendors (including, if relevant, a specialist in transparent/holographic solutions), and attach a clear FAT/SAT checklist and spare strategy to your RFP. Doing that once, properly, will raise the standard for every LED project that follows.

References

- Mordor Intelligence – LED Display Market Size & Share Analysis, 2025–2030.

- TrendForce – Global LED display market size data, 2023 (as cited in industry reports).

- Grand View Research – Global Display Market Report and MicroLED market value insights.