A lot of teams I talk to reach the same moment: standing in front of a beautiful glass façade or flagship window, someone says, “What if we make this whole surface holographic?” and suddenly you’re being asked for numbers, specs and timelines before you’ve even finished your coffee. The pressure is real—digital signage budgets are growing fast, transparent displays are all over trade shows, and nobody wants to be the one who signed off on an expensive toy that looks washed out by month three. The real questions tend to be simpler: when is an LED holographic screen genuinely worth the capex, what are the failure traps, and how do you prove ROI in a way finance will actually sign off?

Description: Deep-dive B2B guide on whether an LED holographic screen is worth it for commercial use, with clear ROI logic, engineering specs, use cases, risks, and a practical buyer checklist for 2025 projects.

Quick Answers for Commercial Buyers

An LED holographic screen is worth it when you sell attention and experience (flagships, exhibitions, premium lobbies) and can measure uplift in traffic or conversions.

It is usually not worth it for information-heavy, text-led communication or extremely bright, reflective façades without mitigation.

Typical projects range from a few square meters in exhibitions to tens of square meters in retail; simple payback often sits at 18–36 months if content and location are right.

The main cost drivers are content production and installation/structural work, not just the screen price per square meter.

Expect payback in retail when 3–10% uplift in conversion or ticket sales is realistic and can be tracked.

Marketing/brand, store or facility operations, IT/AV, and finance all need a seat at the table for a sound decision.

If your team cannot support a content and maintenance plan, a simpler transparent LED or crystal film solution may be the safer, higher-ROI choice.

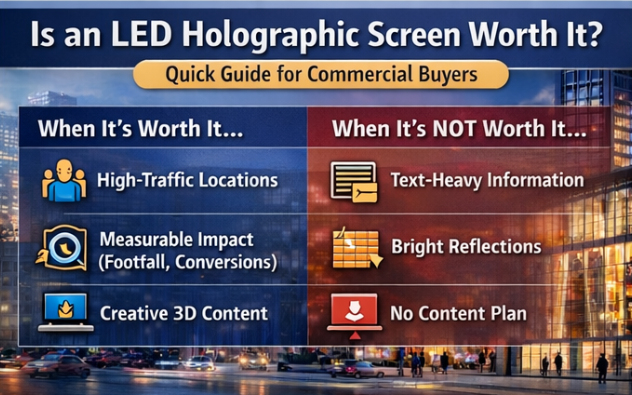

When an LED Holographic Screen Is Worth It – and When It Is Not

The honest answer is: it’s “worth it” only where attention and perceived innovation directly translate into money or strategic value.

It tends to be worth it when:

You have high-value traffic (flagship retail on busy streets, major malls, airports, A‑grade offices).

You can quantify uplift: more footfall, higher dwell time, higher conversion, or sponsored content revenue.

The glass/space can support the right brightness, transparency, and viewing angles.

You have or can buy a realistic content pipeline, including 3D-style animations.

It is not worth it when:

You mainly show detailed text, menus, timetables, or compliance notices.

The façade sits in full harsh sun with heavy reflections and you cannot address shading or background.

You have no in-house or agency support for animated or pseudo‑3D content and will end up looping one generic video for three years.

Maintenance access is poor (e.g., double-skin façades with limited access) and downtime is expensive.

Expert view: “If you can’t write down in one sentence how this installation will change customer behavior, you’re not ready to buy the hardware.”

In early-stage conversations I encourage teams to phrase the decision as: “Is this a long-term media asset with measurable impact, or a one-off sculpture?” The first can justify a six-figure budget. The second usually cannot.

Typical Budgets, Payback Periods and Project Sizes in Retail, Exhibitions and Lobbies

Numbers vary by region and design, but there are recurring patterns.

For retail storefronts, a common range is 5–20 m² of LED holographic or transparent film on main windows. With decent brightness (3000–5000 cd/m²) and 90–95% transparency, installed costs frequently land in the high four to low six figures in USD once you include structure, power, controller, and basic content.

For exhibitions and museums, projects are often smaller in area but heavier on content. You might see 3–10 m² of screen but a significant budget for storytelling, interactive elements, and show control. The ROI is often tied to sponsorship, ticket yield or brand perception rather than direct sales.

Corporate lobbies and showrooms sit somewhere in between. Capex can be similar to retail, but “return” is often softer: perceived innovation, partner confidence, executive alignment. You still should quantify it—e.g., replacing part of your event production spend or external media buying.

Payback: when measurement is in place, simple payback for strong locations often falls in the 18–36 month band. Shorter than 12 months usually means you undercounted some costs; longer than 48 months may indicate the concept or location is wrong.

Who Inside Your Organization Should Be Involved in the Decision

Projects fail less when the right people are in the room early.

At minimum, you want:

Brand/marketing or retail operations to define the use case and content roadmap.

Facilities or architecture to evaluate glass, structure, access and safety.

IT/AV to integrate CMS, networking, remote control, and monitoring.

Finance or procurement to validate TCO, depreciation and vendor selection.

If only marketing is driving the conversation, hardware risk is usually underestimated. If only engineering leads, the experience can become technically perfect but underwhelming visually.

Practical tip: Ask each stakeholder to write down one “show‑stopper” risk from their perspective. Use that list as a design constraint from day one.

What an LED Holographic Screen Really Is (and What It Is Not)

Core Technologies: Transparent LED, Crystal Film and Holographic LED Fans Explained in Simple Terms

“Holographic” in commercial signage is mostly branding. What you typically see on glass or in open frames falls into a few buckets:

Transparent LED screens: rigid or modular LED strips on clear substrates or frames, leaving most of the area open.

LED crystal film or adhesive film: ultra-thin, flexible film with embedded LEDs that is laminated or stuck onto glass.

Holographic LED screens: high-transparency LED structures (often film-like or bar grids) marketed for “floating” visuals on glass.

Holographic LED fans: spinning LED blades using persistence of vision to draw images in the air.

For storefronts and façades, you are usually choosing between transparent LED, crystal film, and holographic-branded transparent solutions. Fans and projection are more for local focal points or enclosed spaces.

Why the “Holographic” Effect Is Not a True 3D Hologram in Commercial Displays

True holography involves recording and reconstructing light fields; these products do not do that. Instead, they draw bright pixels on a mostly invisible structure, with the real world visible behind.

Your eye reads bright moving shapes “floating” in front of the background, especially when content uses silhouettes, outline graphics, and parallax cues. That’s enough to feel futuristic in a retail window, but it is still a 2D surface.

This matters because:

No viewer tracking: everyone sees the same perspective; “3D” is an illusion in the artwork.

Content design is critical: subtle shading and dark scenes often fail; high contrast and bold forms win.

Expectation management: call it “holographic-style transparent LED” when talking to internal teams so nobody expects science-fiction volumetric displays.

Key Components and Architecture: LED Modules, Controllers, Glass, Power and Network

Regardless of branding, a serious commercial system includes:

LED modules or film: providing brightness, pixel pitch, and transparency.

Power supplies and distribution: sized for peak and average load (e.g., a product might quote 865 W/m² peak and 330 W/m² average).

Controllers and receiving cards: handling video input, scaling and synchronization.

CMS/player: for scheduling content, sometimes cloud-based.

Mounting system: framing, adhesives, or clamp profiles on glass or structure.

Network and monitoring: to update content and check health remotely.

Vendors like Zhenmei Wisdom, who manufacture both LED holographic screens and crystal film solutions, usually publish transparency, brightness and power density ranges. Those numbers are your reality check when you map concepts to real buildings.

Commercial Use Cases Where an LED Holographic Screen Delivers Real Value

Retail Storefront Windows: Increasing Footfall and Dwell Time on Busy Streets

Storefront glass is where holographic-style screens earn their keep. On a busy street, any tool that can pull heads away from phones for two seconds has value.

Typical winning scenarios:

Flagship fashion, luxury, sports retail where window storytelling is already a core marketing channel.

Malls where tenants compete heavily for attention and lease rates are high.

Street-facing windows with enough setback to avoid extreme direct sun or where shading is possible.

The screen works as a dynamic layer on the glass: product silhouettes, anamorphic illusions, seasonal campaigns. When tied to merchandising inside the window, you can measure uplift in entry rates and basket size.

Data point: Global digital signage market estimates in 2024 are in the USD 22–28B range with strong growth towards 2030+, showing that “screened” façades are becoming a mainstream budget line, not an experiment.

Museums, Galleries and Exhibitions: Storytelling, Sponsorship Visibility and Temporary Builds

In cultural and exhibition settings, the value is less about pure sales and more about narrative and sponsorship.

An LED holographic screen on a glass partition can:

Reveal layers of an artifact with animated overlays.

Provide bilingual content without heavy printed panels.

Offer premium “digital canvas” inventory to sponsors.

Because many exhibitions are temporary, film-based or modular systems with lighter structure are attractive. You trade absolute ruggedness for speed of install and tear-down.

Corporate Lobbies, Showrooms and Events: Premium Brand Image and Stakeholder Engagement

For corporate environments, these screens become architectural media. A high-transparency display in a lobby can show product stories, data visualizations, or partner recognition without turning the space into a dark video wall cave.

Here, “worth it” is about:

Replacing part of your event production costs (less printed signage, reusable content).

Supporting sales and investor storytelling in showrooms.

Signaling innovation to recruits and partners.

These effects are harder to reduce to a single ROI percentage, but they matter in industries where perceived technology leadership is a competitive signal.

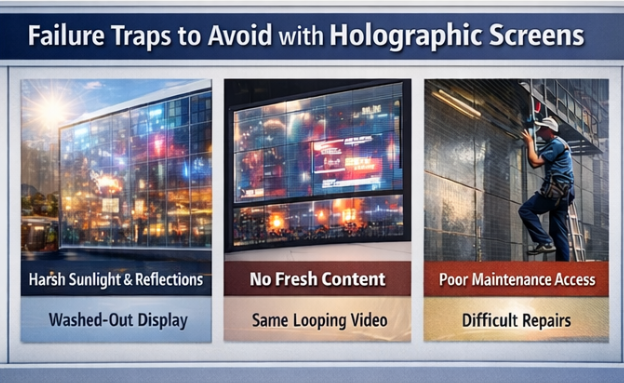

When an LED Holographic Screen Is Not Worth It: Common Failure Scenarios

Daylight, Black-Level and Reflection Issues That Kill the Holographic Illusion

The single most common failure: daylight and reflections wash everything out.

Transparent LEDs and crystal film sacrifice black level for transparency. On a bright street with reflective glass, that means:

Dark scenes vanish; only the brightest whites remain readable.

Viewers see their own reflection and cars behind them more than your content.

At shallow viewing angles, structural elements become visible.

Mitigations include choosing higher brightness (e.g., 4000–7000 cd/m² for strong daylight), anti-reflective glass, dark backdrops behind interior windows, and content built around bold silhouettes instead of fine detail. If none of these are feasible, a conventional high-brightness LCD or solid dvLED behind glass may be a better choice.

Content and CMS Gaps: When 3D-Style Content Production Costs Outweigh Benefits

Many projects underestimate content. The question is not “Can we produce one amazing 30-second animation?” but “Can we keep this surface relevant for 3–5 years?”

Hidden costs show up in:

3D modeling and animation for each campaign.

Adapting existing video to transparent backgrounds (often requires re-compositing).

CMS integration to schedule per time of day, promotions, and local regulations.

If your team cannot budget for at least a few substantial new pieces per year plus ongoing adaptation, consider a simpler transparent LED concept with more static compositions. The hardware will not fail; the experience will.

Operational Pitfalls: Maintenance Access, Spare Parts, Noise and Safety Concerns

Engineering pitfalls tend to surface only after handover:

Modules or film placed where a cherry picker cannot reach.

No spare parts on site, with long lead times for replacements.

Oversized power supplies generating heat with no airflow path.

Hologram fans installed in quiet environments where noise or blade safety is unacceptable.

Actionable advice: include a “maintenance walk-through” with your vendor at design stage and require a spare-parts and access plan that operations signs off on.

Comparing LED Holographic Screen, LED Crystal Film and Other Transparent Displays

LED Holographic Screen vs LED Crystal Film Screen vs Transparent LED Cabinet

At a high level:

LED holographic / transparent LED: higher brightness, modular, strong visual impact, slightly more visible structure.

LED crystal film: ultra-thin, excellent transparency, easier to retrofit on existing glass, but lower peak brightness and sometimes lower robustness.

Transparent LED cabinet: structural frames with LED strips; good for larger façades, often less “invisible” but more serviceable.

If your façade is existing glass with limited structure, crystal film or holographic film products are attractive. For larger digital façades with known loads and steelwork, transparent cabinets may be more economical and maintainable.

Holographic LED Screens vs Hologram Fans vs Projection Film vs LCD Window Displays

Fans excel at local, eye-level, object-like illusions in controlled zones: product pedestals, small alcoves, trade show plinths. They are less ideal for large area messaging, quiet environments, or detailed text.

Projection film can be good for darker interiors where you can control light and are comfortable with projector maintenance and alignment.

High-brightness LCD window displays excel for information-dense content and daytime readability but block transparency and alter the feel of the storefront.

In short:

Need wow effect over a small area: consider a fan or localized transparent LED.

Need legible, data-heavy content: consider LCD or dvLED behind glass.

Need large, transparent canvas for experiential content: consider holographic or crystal film solutions.

Decision Matrix: Which Technology Suits Your Venue, Budget and Message Type

A pragmatic rule-of-thumb:

Transparent/holographic LED for: bold visuals, brand stories, product silhouettes, medium text at moderate distances.

Crystal film for: lighter construction, high transparency, moderate brightness, where structure is constrained.

Conventional LED/LCD for: detailed content, high information density, or very bright environments you can’t mitigate.

Vendors offering multiple technologies, such as Zhenmei Wisdom, can often propose a portfolio approach rather than forcing one technology into every use case.

ROI Framework: How to Calculate Payback for a Commercial LED Holographic Screen

Cost Inputs: Hardware, Installation, Structural Work, Content Production, CMS, Power and Maintenance

Think in terms of total cost of ownership over 5–7 years. Main buckets:

Hardware: screen modules/film, power, controller, sensors.

Installation: steel or aluminum structure, glass work, cabling, labor, permits.

Structural/architectural: reinforcement, access platforms, safety systems.

Content: initial hero content plus yearly campaigns.

CMS and control: licenses, servers/players, integration.

Power: energy consumption (e.g., 330 W/m² average) multiplied by hours per year and local tariffs.

Maintenance: cleaning, inspections, spares, service contracts.

Executable suggestion: build a simple spreadsheet with at least these cost lines and a 5–7 year horizon; decisions made without this view are almost always biased towards underestimating lifetime spend.

Benefit Inputs: Footfall Lift, Dwell Time, Conversion Rate and Media Value Replacement

On the benefit side, don’t rely only on “it looks better.” Choose measurable levers:

Footfall lift: percentage increase in people entering the store or exhibition zone.

Dwell time: increased time in front of the window or within the activation.

Conversion: percentage of visitors who buy or register after exposure.

Media value: cost you would have paid to buy equivalent impressions on external media.

You can instrument these using door counters, in-store analytics, POS data, and simple A/B tests (e.g., new content vs old content periods).

Worked Examples: Simple Payback and Total Cost of Ownership for Retail and Exhibition Projects

Take a simplified retail scenario: 10 m² of holographic transparent LED on a flagship window.

Total 5-year TCO (rough):

Hardware and install: $120,000

Content (initial + updates): $60,000

CMS and power and maintenance: $20,000

Total: $200,000 over 5 years.

If the store averages $5M annual revenue, a 2% uplift attributable to improved storefront storytelling equals $100,000 per year. Over 5 years, that’s $500,000 incremental revenue.

Even if only half of that uplift is conservatively attributed to the screen, you are at $250,000 benefit vs $200,000 cost—simple payback around 4 years and a positive ROI within typical depreciation cycles for digital assets.

For exhibitions, ROI might be framed as sponsor revenue or ticket uplift instead; the math is similar, but time horizons are shorter, and content is a bigger share of the budget.

Key Specifications That Determine Real-World Performance

Brightness and Transparency Targets for Indoor Malls, Lobbies and Street-Facing Glass

Brightness (cd/m²) and transparency (%) are a trade-off. Higher transparency often reduces effective contrast.

Typical targets by environment:

Indoor mall lobbies: 1200–2500 cd/m², transparency 70–90%.

Street-facing glass with partial shade: 3000–5000 cd/m², transparency 85–95%.

Very bright or sunlit façades: 5000+ cd/m², but you should also address reflections structurally.

Some commercial holographic products, including those from Zhenmei Wisdom, cite transparency around 90–95% and brightness up to 7000 cd/m² for certain series. Use these as reference points when evaluating whether a proposed product is appropriate for your ambient light conditions.

Pixel Pitch and Viewing Distance Rules for Legible Text, Logos and Product Visuals

A simple rule many engineers use: optimal viewing distance in meters is roughly 1–3 times the pixel pitch in millimeters. If your audience is 8–10 meters away, a 3–4 mm effective pitch may be acceptable; for closer viewing, you’ll want tighter pitch.

However, transparent structures often effectively increase perceived pitch because of open areas. For text on transparent glass:

Reserve tight text for larger pitches and closer distances.

Use high-contrast typefaces and avoid very thin strokes.

Treat the display more like a giant animated poster than a spreadsheet.

Refresh Rate, Grayscale, Color Accuracy, Power Density and Thickness/Weight Constraints

Engineering teams should also compare:

Refresh rate: higher rates reduce flicker in camera and in-person, especially in bright environments.

Grayscale/bit depth: important for smooth gradients and premium brand imagery.

Power density: affects electrical infrastructure and HVAC; peak vs average matters.

Thickness and weight: critical for glass load calculations, especially with film plus cabling and power boxes.

Ask vendors for full datasheets, not just marketing brochures, and check that claimed specs align with reference values from established transparent LED and holographic series.

Engineering and Installation Checklist for Glass, Façades and Booths

Glass and Structure Compatibility: Laminations, Load, Mounting and Cable Routing

Start with the substrate. Questions to answer early:

What type of glass: single, double, laminated, structural?

Can it accept additional loads or adhesive film?

Where can you route power and data without visible clutter?

Is the surface accessible from inside for install and maintenance?

For film-based solutions, you may need lamination or specific adhesive compatibility. For cabinets, you need anchors into structure that meet local codes.

Dealing with Reflections, Ambient Light and Heat: Practical Engineering Solutions

To control reflections and heat:

Consider external shading devices or overhangs.

Use interior dark backdrops behind certain areas to improve contrast.

Plan ventilation behind power supplies and controllers.

Avoid placing high-power equipment in sealed cavities without airflow.

Many underperforming installs could have been dramatically improved with relatively simple shading or backdrop decisions made during design.

Safety, Regulations and Access: Fire Codes, Emergency Egress and Maintenance Planning

Local building codes and fire regulations may dictate:

Cable types and routing.

Clear widths around exits and on façades.

Load limits on glass and structures.

Plan maintenance access from the beginning: safe access routes, anchor points for lifts or scaffolding, and spare modules stored on site or at a regional warehouse.

Operations and Content: Making a Holographic Screen Work Every Day

Content Strategy for Transparent and Holographic-Style Displays in Commercial Spaces

Content needs to respect the transparent nature of the medium.

Effective strategies:

Strong silhouettes and outlines, high contrast, limited color palettes.

Motion that draws the eye from outside to inside the store or venue.

Occasional “reveal” moments where real products behind the glass align with on-screen graphics.

Avoid heavy use of small text, low-contrast gradients, and footage shot for conventional screens without adaptation.

Workflow, CMS and Remote Control Across Multiple Sites or Venues

For multi-site brands, central CMS and cloud control are essential. Look for:

Role-based access so local teams can adjust some content but not break global standards.

Scheduling by time of day, campaigns, and local regulations.

Integration with other digital signage platforms where needed.

Remote monitoring should flag offline players, temperature issues, and module failures so you don’t find out from a customer post on social media.

Maintenance Routines, Monitoring, Uptime Targets and Spare-Part Strategy

Agree on uptime targets (e.g., 98–99%) and align maintenance accordingly:

Regular cleaning of glass and LED surfaces.

Scheduled visual inspections and log reviews.

On-site spares for critical modules and power supplies.

Clear escalation paths for service and parts replacement.

Expert note: many vendors quote LED lifespans in the 50,000–100,000 hour range, but real-world longevity depends on heat, driving current and maintenance. Your warranty and SLA are at least as important as the raw “hours” number.

Procurement and Risk Management for B2B Projects

RFP and Contract Checklist: Technical Specs, Interoperability and Integration Requirements

Your RFP should, at minimum, specify:

Required brightness and transparency by environment.

Pixel pitch, refresh rate, grayscale and color performance.

Power density and allowed heat load.

CMS features, APIs and integration expectations.

Structural and glass constraints with any approved mounting methods.

Ask suppliers to document how their proposed series meets or exceeds these targets, using real datasheets.

Acceptance Testing on Site: Readability, Uniformity, Reflections and Connectivity

Before sign-off, perform acceptance tests including:

Daytime and nighttime readability at defined viewing points.

Color and brightness uniformity across modules.

Reflection behavior in real ambient conditions.

CMS operation, failover content and remote access.

Use a checklist and take photos and measurements so everyone agrees on pass/fail criteria.

Warranty, SLA and Vendor Selection: Response Times, Lifespan Claims and Upgrade Paths

Key commercial terms to negotiate:

Warranty duration on LED modules, power supplies, and controllers.

On-site response times and replacement lead times.

Availability of spare parts over the life of the installation.

Options for future upgrades (e.g., pitch, brightness) without full rebuild.

Shortlisted vendors that manufacture multiple transparent technologies—such as portfolios including holographic screens, crystal film and other transparent LED—are often better positioned to give you a technically honest recommendation for each site rather than a one-size-fits-all push.

Industry Case Snapshots and Benchmarks

Retail Flagship Case Snapshot: Measuring Uplift from Holographic Storefront Signage

In practice, strong flagships often see measurable changes after a holographic-style window goes live:

Door counters show a 5–15% footfall increase during campaign peaks.

Dwell time in front of the window doubles when animated content runs.

Specific promoted categories see higher conversion in POS data.

The key is to baseline for several weeks before installation, then run structured measurements for A/B periods (new content vs old) rather than relying on anecdotes.

Museum or Exhibition Booth Example: Balancing Wow Effect with Temporary Structures

For a traveling exhibition, a thin crystal film or holographic film laminated onto rental glass can create a striking “floating label” effect without heavy structures. The project becomes “worth it” when:

Sponsors pay for the digital presence.

Content can be reused across cities with minor localization.

Install/tear-down cycles are fast and predictable.

The main risk is overspecifying hardware for a environment where power, rigging and time are constrained; pilot one city before scaling.

Portfolio Approach: Combining Holographic Screens with Conventional Digital Signage

Some of the most effective deployments use a mix:

Holographic/transparent LED on prime glass for wow factor.

Conventional dvLED or LCD inside for detailed storytelling and offers.

Small hologram fans at hero products for localized effects.

This “portfolio” approach lets each technology play to its strengths and stabilizes ROI across different content types and lighting conditions.

Common Misconceptions, Risks and How to Avoid Them

Myths About “Any Glass Works” and “Content Is Easy to Reuse”

Two persistent myths derail projects:

“Any glass works”—in reality, some insulated or structural glass types are unsuitable for adhesives or extra loads without engineering approval.

“We’ll just reuse existing video content”—most conventional assets are not designed for transparency or the specific aspect ratios of glass façades.

Challenge these assumptions early and budget for glass engineering checks and content adaptation.

Underestimating Power, Heat and Building Integration Requirements

Another recurring issue: infrastructure. High-brightness transparent LED is still LED—it consumes power and produces heat.

Coordinate with building engineers on:

Power circuits, load profiles and redundancy.

Heat rejection in cavities, especially in hot climates.

Conduit routes, penetration details, and firestopping.

How to Stress-Test Vendor Claims Before You Sign the Contract

Before awarding a contract, request:

A small-scale on-site demo or mockup at the actual glass, if possible.

Full datasheets with transparency, brightness, power, weight and control options.

References for similar projects in comparable environments.

Ask vendors to run their own ROI/TCO calculation using your assumptions and compare it against your internal model. Differences will tell you where expectations diverge.

Frequently Asked Questions from Commercial Buyers

How Does an LED Holographic Screen Actually Work in a Busy Commercial Environment?

It uses a high-transparency LED structure or film mounted on glass or in open frames. Bright pixels form images that appear to float in front of real-world backgrounds. The illusion depends heavily on ambient light, reflections, viewing distance and content design.

What Lifespan and Operating Hours Can You Realistically Expect from the Display?

Many commercial LED products quote lifespans in the 50,000–100,000 hour range at nominal conditions. In real use, thermal management, driving current, cleaning and power quality can shift that. Focus less on headline “hours” and more on warranty terms, derating for your environment, and planned maintenance.

How to Decide Between a Holographic Screen and a Simpler Transparent LED Solution?

Start with your primary goal. If it is maximum wow on glass with cinematic campaigns and you have the content budget, a holographic-style solution is appropriate. If you need reliable, legible messaging with simpler content, a more conventional transparent LED or crystal film configuration may offer better value. When in doubt, pilot a smaller area and measure.

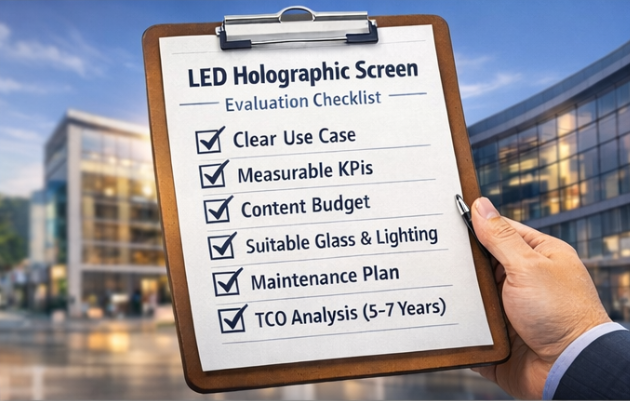

Conclusion and Next Steps for Your Project

For commercial buyers, the question “Is an LED holographic screen worth it?” only has a useful answer when you tie it to a specific location, behavior change and measurement plan. In high-value contexts—flagship retail, exhibitions, premium lobbies—these systems can repay their cost as part of a broader digital signage portfolio, provided you respect the physics (light, reflections, pixel pitch) and the operations (content, CMS, maintenance).

Quick decision checklist: clear use case, measurable KPI, suitable glass and lighting, content budget, operations ownership, and a realistic 5–7 year TCO model.

As you brief vendors, share both your creative ambitions and your engineering constraints. Ask for specs, mockups and references, not just renderings. If you want to see how holographic screens, crystal film and other transparent LED options can be combined in one portfolio, it is worth exploring a specialist transparent LED partner’s learning hub and solution overviews at a later stage in your evaluation.

References and Further Reading

Grand View Research – Digital Signage Market Size and Forecast, 2024–2030.

Global Market Insights – Transparent Display Market Report, 2023–2032.

AV industry technical resources on transparent LED and holographic-style display engineering and ROI best practices.