According to foreign media reports yesterday (7/15), South Korea's Ministry of Trade, Industry and Energy announced that it would invest 484 billion won (approximately US$350 million or 2.51 billion RMB) by 2032 to develop iLED (Inorganic Light-Emitting Diode) display technology, including Micro LED, QD LED, and nano LED.

The South Korean government stated that while the country currently holds a leading position in the OLED market, it still lags behind other nations in the iLED sector. Its corresponding LED epitaxy, chips, and materials are still heavily reliant on imports. The goal of this investment is to cultivate a complete localized industrial ecosystem, uncovering new growth engines for South Korea's display industry.

Fierce OLED Competition + Supply Chain Security Concerns: South Korea Bets Big on iLED

It's understood that in the past, South Korea, with its giants Samsung and LG, virtually monopolized the global OLED market. However, in recent years, Chinese companies like BOE, TCL CSOT, Visionox, HKC, and Tianma, backed by government support, have rapidly risen. They have not only completely surpassed South Korea in the LCD panel sector but are also accelerating their efforts in the OLED field, actively catching up to Korean manufacturers.

Specifically, South Korea currently maintains an advantage in high-end flexible OLED and similar markets. However, Chinese manufacturers are rapidly increasing their market share in the mid-to-low-end OLED segment, and the technology gap is continuously narrowing. Furthermore, Chinese companies are also catching up in the research and development of advanced technologies like FMM-less OLED. For instance, Visionox's ViP technology mass production process was fully validated in 2023 and will be introduced on their new G8.6 generation AMOLED production lines. Meanwhile, TCL CSOT's printed OLED technology is also expanding from professional-grade to consumer markets, directly targeting the huge potential of the mid-size application market.

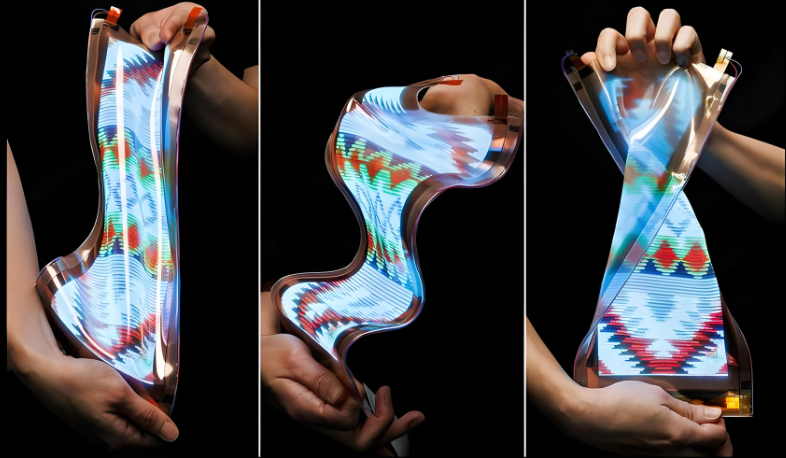

Moreover, iLED technology is considered the next-generation display technology poised to disrupt OLED. Compared to OLED, iLED uses inorganic materials, offering superior performance in terms of lifespan, brightness, picture quality, and energy efficiency. It avoids issues like 'burn-in' (image retention) and brightness limitations that can occur with long-term OLED screen use. Its development potential in areas like automotive displays, mobile devices, and wearables is highly promising.

It's also worth noting that iLED technology, especially Micro LED, has a significantly different industry chain logic compared to OLED. The former's core lies in the manufacturing, inspection, and transfer of micron-sized LED chips, which places it closer to the semiconductor industry. China, with its robust LED industry foundation, complete industrial ecosystem, and national policy support, has designated Micro LED as a key development area. Many companies have invested heavily in R&D and achieved breakthrough progress. For South Korean manufacturers, Chinese companies are coming on strong.

While South Korean companies were early movers in technologies like Micro LED and QD LED, issues with production capacity have led to a high reliance on foreign sources for key components and materials, creating a vulnerability in their supply chain security.

South Korea's Ministry of Trade, Industry and Energy also directly pointed out in its statement that the country's current demand for iLED chips and materials is highly dependent on imports. This means that if the market shifts towards iLED in the future, South Korea might not only fail to continue its OLED success but could also find itself in a passive position in future competition due to a lack of core technologies and upstream supply chain.

To get ahead in this global race that will shape the display industry over the next decade, South Korea actually first focused intently on the complete iLED display application ecosystem back in May 2022, launching national-level special investments, acting as both a challenger and a supply chain builder. Against this backdrop, Seoul Semiconductor has continuously explored the growth potential of Micro LED and other technologies in recent years. Their Micro LED products, based on WICOP unpackaged technology, have already entered mass production, being used in commercial display scenarios such as outdoor advertising and virtual studios.

Now, South Korea's Ministry of Trade, Industry and Energy has officially announced the launch of this large-scale national R&D project for iLED, with clear objectives directly addressing key pain points. As the South Korean government frankly stated, this investment aims to tackle three major issues: first, to reverse South Korea's relatively lagging technological position in the iLED sector; second, to reduce its heavy reliance on foreign-made critical LED chips and core materials, establishing an independently controllable local supply chain; and third, to find new economic growth engines for the nation beyond OLED.

Overall, South Korea's government investment in iLED development is, on one hand, to address its own shortcomings in next-generation technology, prevent competitors from 'leapfrogging' (overtaking in the curve), and ensure the supply chain security of key national industries. On the other hand, it hopes to replicate the success of OLED in the blue ocean market of iLED by being the first to break through technological bottlenecks, thereby continuing to lead the global display industry's development.

From the perspective of the global display industry, this technology will impact the evolutionary path of display technologies worldwide. Regardless, the global race for iLED has fully begun, and future developments in various regions will continue to be closely watched.